Our Bureau

New Delhi

India’s retail inflation rose to 2.75 per cent in January 2026, the first official reading under a revamped Consumer Price Index (CPI) series with 2024 as the base year, government data showed on Thursday. The figure marks a noticeable uptick from the 1.33 per cent recorded in December 2025 under the old 2012‑based series, even as inflation remains within the Reserve Bank of India’s 2–6 per cent tolerance band around its 4 per cent medium‑term target.

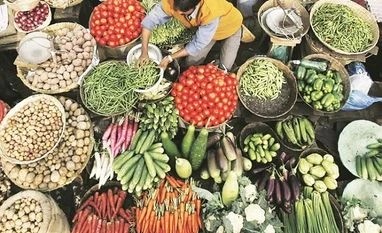

The new CPI framework, released by the National Statistics Office (NSO), updates the base year to 2024=100 and reweights the consumption basket to better capture shifts in household spending, including more emphasis on services, housing and online consumption. Food’s share in the index has been trimmed to about 36.8 per cent from nearly half earlier, while non‑food and service categories now account for over 60 per cent, reflecting rising outlays on housing, health, education and discretionary services.

Within the 2.75 per cent headline, rural inflation stood at 2.73 per cent and urban at 2.77 per cent, indicating broadly similar price pressures across regions. Food and precious metals led the uptick, while housing inflation under the new series came in at around 2.05 per cent, with clothing and footwear at 2.98 per cent and restaurants and accommodation services at 2.87 per cent.

Economists said the move back into the RBI’s target band, after months of undershooting, could prompt the central bank to hold rates steady for an extended period, even as growth remains relatively resilient. The overhaul also aims to improve the accuracy of inflation‑forecasting models that had repeatedly over‑projected price pressures in recent years.