Finance Minister Nirmala Sitharaman presents a bold budget ahead of the election year. The government calls it’s a roadmap for development. How is the industry and consultants reacting to it?

Our Bureau

New Delhi

Finance Minister Nirmala Sitharaman presented the Union Budget 2023 in Lok Sabha on Wednesday. This was the third time in a row that the government presented the budget in a paperless form. Highlights of the budget presented by minister included big incentives under the new income tax regime. And, more importantly, the capital expenditure outlay has been increased by 33 per cent, accounting for 3.3 per cent of the GDP.

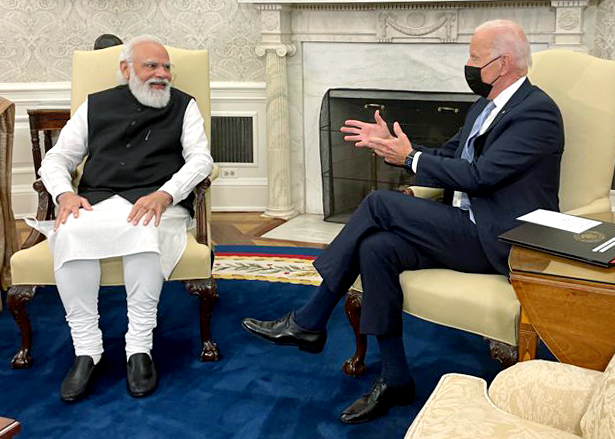

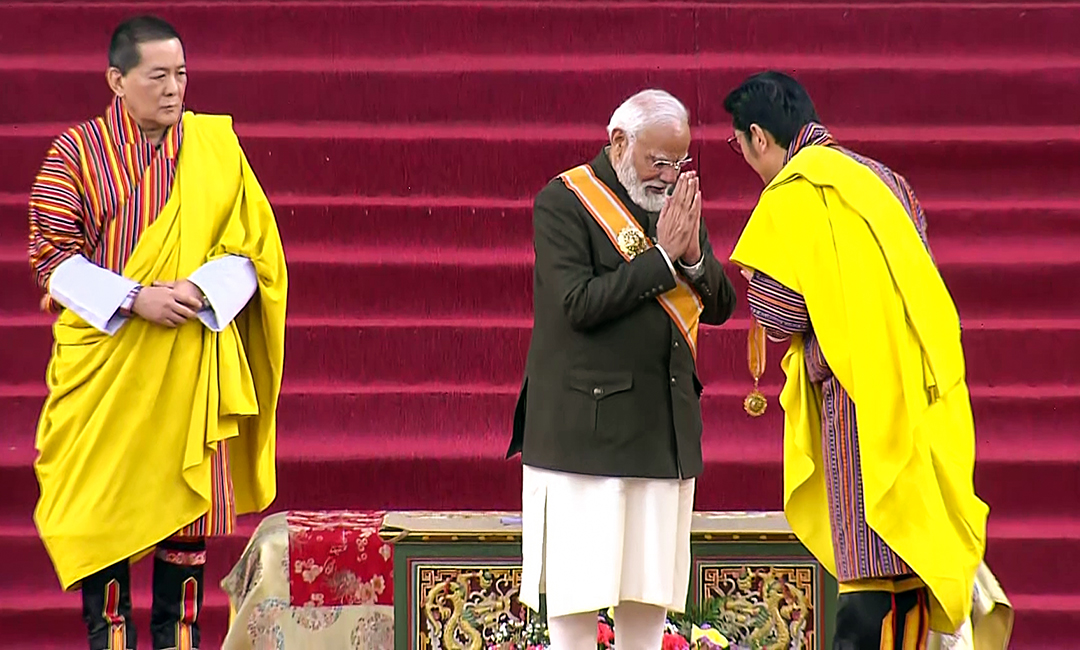

The annual Budget for 2023-24 is the last full Budget of Modi government 2.0. This year’s Budget holds much significance as it is the last of the Narendra Modi government before the next Lok Sabha election in April-May 2024.

Prime Minister Narendra Modi on Wednesday hailed the “first budget of Amrit Kaal” and said that it would lay a strong foundation for building a developed India. The Prime Minister said that the budget gives priority to the deprived and will fulfill the dreams of the aspirational society, the farmers and middle class. “The first budget of Amrit Kaal will build a strong foundation for building a developed India. It gives priority to the deprived. This budget will fulfil the dreams of an aspirational society including poor people, middle-class people, and farmers. I congratulate Nirmala Sitharaman and his team for this historic budget,” PM Modi said in a televised address.

Prime Minister Modi underlined the government’s efforts to enhance the lives of women. “The government has taken several steps to make the lives of women, in rural and urban areas, easy. Women’s self-help groups will further enhance them. Special savings scheme will be started empowering women in households,” the PM said.

The proposed Union Budget 2023-24 largely focuses on green growth, urban infrastructure, and technology. Contrary to the expectations, there were no direct announcements for the real estate sector. However, the government continued to focus on the affordable housing segment by increasing the capital outlay. The commercial real estate sector would also be benefitted by the incentives provided for start-ups, fintech companies and enhancing ease of doing business.

“Overall, the budget focuses on driving consumption and capital investment to support growth. This will have a multiplier effect on various sectors such as real estate. At the same time, the government’s commitment towards affordable housing continues with a significant jump in PMAY allocation. On the commercial front, the continuous push to startups will give a fillip to activity in commercial office space,” said Ramesh Nair, Chief Executive Officer of Colliers.

The government’s continued focus on capital investment will give a boost to India’s growth, said Fitch Ratings, a day after the finance minister presented the annual Budget for 2023-24.

“The government’s continued emphasis on ramping up capex spending should provide a fillip to both near- and medium-term growth,” Jeremy Zook, Director and Primary Sovereign analyst for India, Fitch Ratings, said. “We believe India is well-placed to sustain higher rates of growth in the medium-term than many of its peers, with the capex drive helping to underpin this view,” Zook added.

Capital investment outlay for 2023-24 is being increased steeply for the third year in a row. “This will be almost three times the outlay in 2019-20,” finance minister Sitharaman said in her Budget speech on Wednesday.

This increase in recent years, she said, is central to the government’s efforts to enhance growth potential and job creation, crowd-in private investments, and provide a cushion against global headwinds.

“This budget sought to maintain a balance of sustaining a growth-oriented focus through a further increase in capex spending, while maintaining an eye toward deficit reduction. The government aims for modest fiscal consolidation, while accommodating a higher capex spend and changes to income tax slabs, largely by substantially reducing subsidies in the coming year,” Fitch Ratings said.

Fitch Ratings, however, cautioned that given the “still uncertain outlook for the global economy and commodity prices”, there is potential downside risk to the deficit target before the next general elections, in particular in the event that a shock such as another commodity price spike leads to pressures for subsidy spending.

But reactions in general have been positive. Subhrakant Panda, president of industry body FICCI, has said the Budget announcements made on Wednesday captured the pulse of the economy. “FICCI congratulates the Hon’ble Finance Minister for delivering a balanced and progressive Union Budget which gives primacy to inclusive growth. The announcements made today capture the pulse of the economy while retaining credibility both in terms of projections as well as committing to the fiscal consolidation glide path,” Panda said post Budget. “Most importantly, a historic outlay for public capex is a continuation of the heaving lifting since the time of the pandemic and will have a multiplier effect across myriad sectors of the economy besides crowding in private investment,” Panda added.

Confederation of Indian Industry (CII) president Sanjiv Bajaj also welcomed the Union Budget for the financial year 2023-24 by saying that this will have a multiplier effect on the economy. “The government managed a tough balancing act of meeting the priorities of growth through capital spending while keeping a fiscal deficit under check. While at the same time very strong focus on inclusion to ensure prosperity for the masses,” Sanjiv Bajaj said. He also appreciated the government’s proposal of increasing the capital investment outlay to 33 per cent to Rs 10 lakh crore for the Financial Year 2023-24.

Chairman of Boston Consulting Group Janmejaya Sinha lauded the Union Budget 2023 presented by Finance Minister Niramala Sitharaman, calling it “clean, simple, clear and solid”.

Speaking on the Personal Income Tax rebate in the new tax regime, Sinha said, “Middle class will benefit most from this year’s budget. Consumption will increase due to this move and the economy will further boost.” He further added that everyone will be benefitted from the move calling the budget “clean, simple, clear and solid.”

The government on Wednesday simplified various tax benefits on MSMEs, cooperatives, startups and boards, authorities and commissions. According to the Union Budget tabled on Wednesday, the government had enhanced limits for micro-enterprises and professionals while availing benefits of presumptive taxation. There is a deduction on payments made to MSMEs to be allowed only when payment is actually made. While for cooperatives, the government extended 15 per cent corporate tax benefits to new cooperatives which would start manufacturing from March 2024.

The government had fixed higher limit of Rs 2 lakh per member for deposits and loans in cash by Primary Agricultural Credit Society (PACS) and Primary Cooperative Agriculture and Rural Development Banks (PCARDBs) and a higher limit of Rs 3 crore for TDS on cash withdrawal for cooperatives.

Union Finance Minister Nirmala Sitharaman announced the government proposes to extend the date of incorporation for income tax benefits to startups from March 31, 2023, to March 31, 2024.

According to the Budget, the government also said it would provide the benefit of carry-forward of losses on change of shareholding of startups from seven years of incorporation to 10 years.

The income of authorities, boards and commissions set up by the statutes of the Union or state to be exempted from income tax in certain sectors.

The government had extended of period of tax benefits to funds relocating to IFSC, GIFT city till March 31, 2025.

In a political statement, emphasizing that the Union Budget 2023-24 is inclusive, that includes all the sections of society, Uttar Pradesh Chief Minister Yogi Adityanath on Thursday said that the budget has a vision for the next 25 years.

Addressing a press conference, the Chief Minister said that in this budget work has been done to provide opportunities to every section of society. “This first budget of the ‘Amrit Kaal’ is one on the idea of a developed India. It is an inclusive budget, that includes all the sections of society. People from all walks of life have been given an opportunity in this Budget,” said Adityanath.

He said that compared to the financial year 2013-14, the Railway Budget is nine times more this time. “If we compare to the 2013-14 Indian Railway Budget, a provision of Rs 2.40 lakh crores has been made this time – 9 per cent more than that in 2013-14,” said the UP CM. He further said that this is a budget to realize the vision of a developed India. He said this is a budget for sustainable and inclusive development.

As the country would go to elections in 2024, the BJP leadership would be happy to give that kind of positive message to the people of India.