Our Bureau

New Delhi

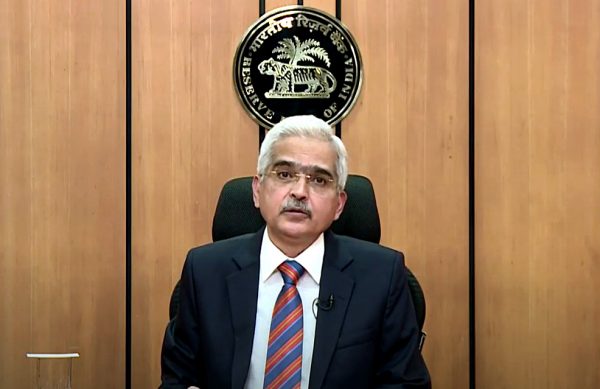

The Reserve Bank of India (RBI) on Friday proposed tighter regulations for large non-banking finance companies (NBFCs) and creation of a multi-layer model in the fast-growing industry.

In a discussion paper it has proposed a multiple layer structure to categorise NBFCs depending on their size and inter-connectedness with the system. The central bank has called for feedback on it. “In view of the recent stress in the sector, it has become imperative to re-examine the suitability of this regulatory approach, especially when failure of an extremely large NBFC can precipitate systemic risks,” the RBI said.

Unbridled growth aided by less rigorous regulatory framework within an interconnected financial system can sow the seeds of systemic risk.

Failure of any large and deeply interconnected NBFC is capable of transmitting shocks into the entire financial sector and causing disruption even to the operations of the small and mid-sized NBFCs, said the RBI.

Under the circumstances, the regulatory framework for NBFCs needs to be reoriented to keep pace with the changing realities, the RBI said.

NBFCs in the lower layer will be known as NBFC-Base Layer (NBFC-BL) and those in the middle layer will be known as NBFC-Middle Layer (NBFC-ML). An NBFC in the Upper Layer will be known as NBFC-Upper Layer (NBFC-UL) and will invite a new regulatory superstructure, the RBI said.

According to the RBI discussion paper, the process of identification of NBFC-UL based on parametric analysis will be conducted as a yearly exercise.

Once identified as NBFC-UL, the NBFC will be advised individually about its classification as a NBFC-UL and that it will be subjected to regulation akin to banks, said the RBI.

The NBFC sector has seen tremendous growth in recent years. In the past five years, the size of balance sheet of NBFCs (including housing finance companies) has more than doubled from Rs 20.72 lakh crore in 2015 to Rs 49.22 lakh crore in 2020.

The RBI said strong and well-governed NBFCs can promote resilience in the financial system by providing a much-needed backup within the system.