India is on the path of fiscal prudence as the government has spent around 52.5 per cent of the budget estimate of its deficit in the first seven months of FY25

Our Bureau

New Delhi

As per the convention, the Budget for 2025-26 will be tabled on February 1, 2025. Discussions are already on about how to boost the growth, with different sections of industry and society giving their feedback. As India prepares for the Budget, expectations are focused on a set of strategic reforms that can propel the economy forward.

Global consulting and professional services firm Ernst & Young India has emphasized on fiscal consolidation, tax system simplification, and investment-driven growth, in the Budget 2025 as it will “lay a solid foundation for sustained economic development in India”.

According to EY India, key areas of focus should be to enhance public expenditure, reduce fiscal deficit, incentivize private sector investment, and introduce targeted tax reforms to foster business innovation.

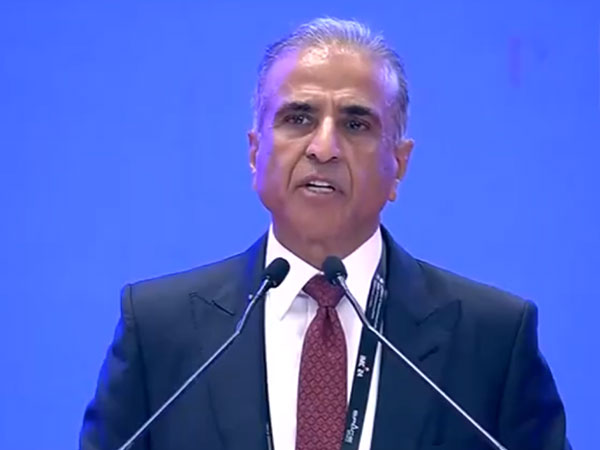

Sameer Gupta, National Tax Leader, EY India, said, “The Government has made significant progress in reforms over the last two terms. The focus now should be on accelerating and executing the key policies announced in recent years.”

For businesses, particularly small and medium enterprises (SMEs), reducing the complexity of tax compliance is critical, EY India said in a statement Wednesday. To achieve sustainable growth in 2025-26, India must prioritize reducing the fiscal deficit to 4.5 per cent of GDP in 2025-26 while reducing the debt-to-GDP ratio, which stands at 54.4 per cent, well above the FRBM target of 40 per cent, said EY India.

To achieve a medium-term real GDP growth target of 6.5 per cent or higher, EY India said it can only be achieved by increasing the government’s capital expenditure, improving capital efficiency and encouraging states to enhance their investment spending.

To stimulate private sector investment, a progressive reduction in interest rates should be considered.

Additionally, targeted employment schemes should be fast-tracked to uplift urban demand and support economic momentum in 2025-26.

EY India also asks for deferring tax deduction at source (TDS) on PF interest rate (above 2.5 lakhs) until the withdrawal stage to reduce compliance burden.

In the previous budget TDS rate rationalization was undertaken to a certain extent. To further simplify the entire gamut of withholding tax provisions, the TDS rate structure could be divided into 3-4 broad categories with lower rates and a negative list.

Meanwhile, in their customary pre-budget meeting with Union Finance Minister Nirmala Sitharaman on Monday, trade union leaders suggested a super-rich tax and an increase in corporate tax to fund social security for informal workers.

Talking to reporters after the meeting, Trade Union Co-ordination Centre (TUCC) National General Secretary S P Tiwari said the government should impose an additional 2 per cent tax on the super-rich to fund social security for informal workers. Tiwari also demanded that agriculture workers be extended social security and that their minimum wages should also be fixed.

Trade Unions also pressed for increasing the minimum Employees’ Provident Fund Organization (EPFO) pension to Rs 5,000 per month from Rs 1000 per month. In other demands, trade unions asked for an immediate constitution of the 8th Pay Commission in the upcoming 2025-26 Budget.

Another report by the Union Bank of India suggests that India is on the path of fiscal prudence as the government has spent around 52.5 per cent of the budget estimate (BE) of its deficit in the first seven months of FY25.

The report highlighted that India’s fiscal deficit for the April-November period of FY25 stood at Rs 8.47 lakh crore, which is 52.5 per cent of the budgeted estimate (BE). This marks an improvement from Rs 9.07 lakh crore, or 50.7 per cent of BE, during the same period last year.

The deficit is significantly lower than the 114.8 per cent recorded in the pre-Covid era, reflecting better fiscal management.

It said, “Fiscal impulse improves in Nov’24; further pickup likely in the rest of FY25. India’s fiscal deficit for Apr-Nov FY25 came in at Rs8.47 lakh crore (52.5 per cent of BE).”

The report noted that after lagging behind the historical trends until September 2024, fiscal dynamics improved from October 2024 onward, indicating stronger fiscal momentum. A positive shift was observed in the quality of government expenditure, with revenue spending being curtailed and capital expenditure (capex) receiving a boost.

This trend is expected to continue, with a sharp increase in government spending likely in the remainder of FY25 while maintaining a focus on quality spending.