Global brokerage firm Morgan Stanley has lowered India’s gross domestic product (GDP) growth forecast for the current financial year to 7.6 per cent

Our Bureau

Mumbai/Beijing

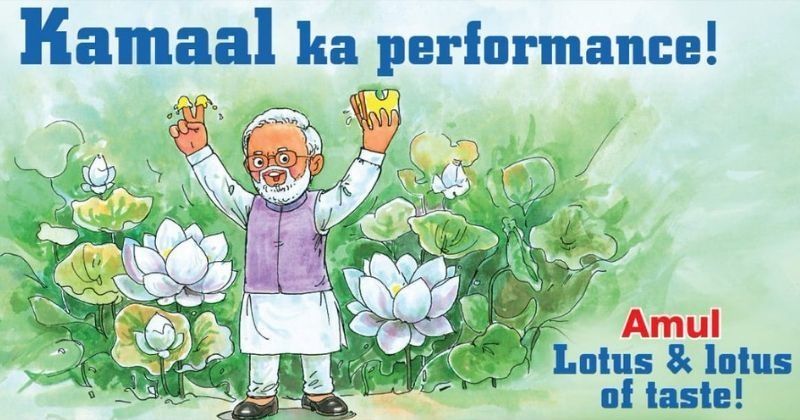

India’s retail inflation surged to eight-year high of 7.79 per cent in April due to a sharp jump in fuel and edible oil prices, the government data showed on Thursday.

The headline inflation is the highest in eight years. Consumer Price Index (CPI) inflation in April 2022 is the highest since May 2014, when it stood at 8.33 per cent. Retail inflation has risen sharply. It stood at 6.95 per cent in March 2022. April 2022 retail inflation data is almost double from 4.23 per cent recorded in April 2021.

The price rise was sharper in rural India. Rural retail inflation rose to 8.38 per cent in April as compared to 7.66 per cent in the previous month and 3.75 per cent in April 2021. Urban retail inflation surged to 7.09 per cent in April as compared to 6.12 per cent in March and 4.71 per cent in April 2021, according to data released by the National Statistical Office (NSO), Ministry of Statistics and Programme Implementation.

A sharp jump in fuel and food prices has led to a multi-year jump in inflation. Food inflation surged to 8.38 per cent in April from 7.68 per cent in the previous month and 1.96 per cent in April 2021.

Also, the Indian stock markets’ key indices, Sensex and Nifty, slumped by more than two per cent on Thursday dragged by heavy selling pressure in banking and metal stocks as high US inflation data dampened investors’ confidence.

The 30 stock S&P BSE Sensex tumbled 1158.08 points or 2.14 per cent to 52,930.31 points against its previous day’s close at 54,088.39 points. Earlier, the Sensex started the trade deep in the red at 53,608.35 points and slumped to a low of 52,702.30 points in the intra-day.

This is the fifth straight session of loss in the benchmark Sensex. IndusInd Bank tumbled 5.82 per cent to Rs 869.45. Tata Steel dipped 4.13 per cent to Rs 1118.15. Bajaj Finance fell 3.76 per cent to Rs 5588. Bajaj Finserv declined 3.53 per cent to Rs 12848.95. State Bank of India plunged 2.93 per cent to Rs 462.45. HDFC Bank dipped 3.34 per cent to Rs 1303.10.

The index heavyweight Reliance Industries fell 1.99 per cent to Rs 2400.95.

Only one of the 30 scrips that are part of the Sensex closed in the positive. Wipro rose 0.91 per cent to Rs 475.50.

Meanwhile, a report from the Chinese capital says that China’s infamous Zero-COVID policy is not only harming the Chinese citizens but is also posing a significant threat to the world as the country’s ‘witless’ rules have left hundreds of cargo ships stranded on the ports which will impact freight costs and global inflation.

Maersk, the world’s second-largest shipping company, has suggested that the lockdown will severely impact truck services and transport costs would perceive a rise at an unexpected level. It is said that 90% of the world’s goods are carried oversea. As freight charges increase it could cause a negative economic spillover on global trade. Businesses will not tolerate this unfortunate development and they will divert the cost on customers, reported Inside Over.

Due to heavy traffic restrictions at the Shanghai port logistics companies have advised vessel operators to offload the products at other ports.

Ultimately customers have to bear the additional shipment and storage charges. Thus, China is going through its worst outbreak and therefore the increase in freight charges could create economic repercussions on global trade as well.

If the delays continue for an unexpected period, other ports may not be capable of filling the void. Some of the factories are finding it challenging to keep the momentum going due to the high COVID curbs.

Many companies are bearing the brunt of China’s stern COVID policies. a lockdown is declared in Changchun city which is a major auto manufacturing hub for brands like Toyota and Volkswagen. Apple supplier Foxconn has also suspended its production amidst the tightened restrictions, as per the media outlet.

In another ominous sign, Global brokerage firm Morgan Stanley has lowered India’s gross domestic product (GDP) growth forecast for the current financial year to 7.6 per cent citing high inflation and global slowdown.

The new growth projection is 0.30 per cent lower from the earlier forecast. The brokerage firm has also lowered India’s GDP growth forecast for the financial year 2023-24 to 6.7 per cent, which is 0.30 per cent lower from its earlier projection.