The new-age billionaires who have created wealth through startups have been giving back a lot to startups by investing back in the ecosystem

Our Bureau

New Delhi

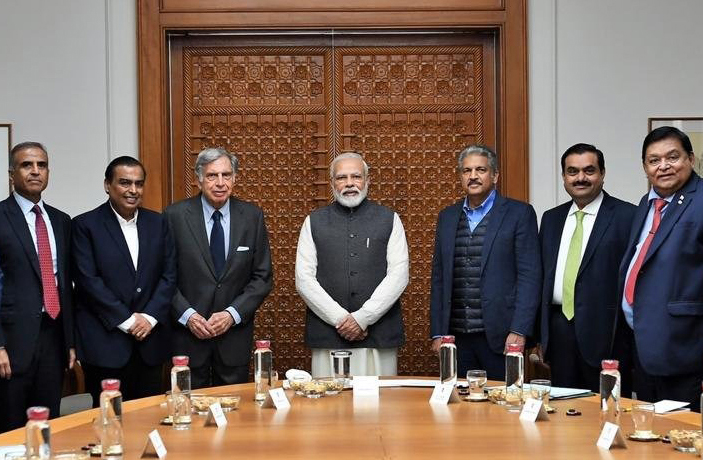

India has added five billionaires every month in the last 12 months as the value of businesses such as chemicals, software and pharmaceuticals soared. Among the traditional billionaires, Gautam Adani (59) and family, with Rs 5.1 lakh crore (a 261% surge), for the first time has become Asia’s second-richest. His family has added Rs 1,000 crore a day over the last year.

Mukesh Ambani (64), with Rs 7.2 lakh crore, remained the richest Indian for the 10th year in a row. The rise in commodity prices has enabled magnates, including Lakshmi Mittal (71) and Kumar Mangalam Birla (54), to be part of India’s top 10. Vaccine king Cyrus S Poonawalla of Serum Institute of India, whose wealth increased by 74% to Rs 1,63,700 crore occupies the 6th position.

Gautam Adani’s brother Vinod Shantilal Adani, who owns a trading business in Dubai, too made it to the top 10, ahead of Birla, with his wealth growing threefold to Rs 1.31 lakh crore.

The last decade has seen the fastest pace of wealth creation with India’s rich adding Rs 2,020 crore of wealth every day for the past 10 years. Hurun, which compiles a list of the super-rich in India in partnership with IIFL Wealth management, has in this year’s ranking highlighted trends for the last decade.

“The number of entrants in IIFL Wealth Hurun India Rich List has grown from just under 100 ten years ago to 1,007 today. At this rate, in five years, I expect the list to grow to 3,000 individuals. The evolution of the IIFL Hurun India Rich List is a reflection of India’s economic growth story,” said Hurun India MD & chief researcher Anas Rahman Junaid.

Following the addition of 59 new billionaires, the number has gone up to 237. Another interesting finding is that, unlike a decade ago, wealth creation is no longer limited to big cities and includes people from Haridwar to Thiruvananthapuram, with the total number of cities at 76.

According to IIFL Wealth joint CEO Anirudha Taparia, most billionaires invest largely in equity and in fixed income securities. Also, most of their money is invested in India where wealth creation is fastest. “They may invest some Rs 10 out of Rs 100 overseas, but most of it is invested back in the country,” he said.

Also, new-age billionaires who have created wealth through startups have been giving back a lot to startups. “They are investing back in the ecosystem. They are far more comfortable in taking this particular risk where there is a lot of illiquidities,” said Taparia. He added that of late there were a lot of pre-IPO investments as well.

For the first time ever, over 1,007 individuals in the country have a net worth of Rs 1,000 crore, the IIFL Wealth Hurun India Rich List 2021 released on Thursday showed.

The report said that India experienced a glorious decade with the richest individuals cumulatively adding Rs 2,020 crore per day — the fastest wealth creation ever experienced by the country. Out of these 1,007 individuals, 13 of them have more than Rs 1 lakh crore of wealth.

Even amid the pandemic situation which battered the economy, total wealth increased by 51 per cent while average wealth was 25 per cent higher. Further, 894 individuals saw their wealth increase or stay the same, of which 229 new faces. Number of billionaires also jumped to 237 till September 15 this year.

However, pent up demand accompanied with timely government policies, accentuated investors interest and the Nifty and Sensex jumped to all-time highs. “The bull-market valuation multiples, resulted in 9 out of 10 people in the list witnessing either an increase or retention in their wealth compared to last year, while 116 individuals doubled their wealth,” he added.

Besides, wealth creation has become more decentralised as the number of cities jumped from 10 a decade ago to 76. At this rate, it is expected that the each of the planned 100 smart cities will have a rich lister within 5 years.

The report further noted that India is third in the world, when it comes to no. of billionaires. India is adding new billionaires at one of the fastest rates.