Sneha M

For decades, the US dollar has solidified its position as the world’s leading reserve currency due to its wide acceptance in almost all international trade transactions. However, due to sanctions and the rise of alternate reserve currencies, the US dollar’s importance in world affairs is increasingly under threat. Fast-growing economies like China, India and others are proactively tapping the benefits of trading in national currencies.

Many countries have periodically considered the use of their national currencies through a range of accords, such as currency swap agreements and bilateral trade settlement agreements. China’s renminbi share in the global reserve currency rose when the Chinese leadership institutionalized multinational financial infrastructure to settle transactions in renminbi. China initiated a Cross-Border Interbank Payment System (CIPS) in 2015, similar to the US Clearing House Interbank Payments System (CHIPS).

India, with its burgeoning economic power, will be a pivotal actor in determining the future of the global monetary system. China and Russia inking a bilateral agreement in 2019 to promote their respective currencies is reflective of like-minded countries coming together to determine economic linkages. On the other hand, multilateral organizations such as BRICS are also questioning their reliance on the dollar. For instance, one of the key issues being discussed at the 15th BRICS Summit at Johannesburg is the need to trade in domestic currencies and exploring a common currency for BRICS nations.

The Growing Trend

The rise of the Euro as a world reserve currency was exceptional, and it is the most used reserve after the dollar. The Australian dollar’s internationalization was a protracted evolutionary process. After many years of currency pegging, capital controls were removed in 1983, and the currency was then allowed to float. Since 1983, the Australian dollar has been a recognized world currency.

In Asia too, several attempts have been made to internationalize local currencies. The Chinese yuan, Indian rupee, and Japanese yen are also used in international trade. In response to the Global Financial Crisis, China launched the ambitious ‘Renminbi internationalization’ project, which had the twin objectives of internationalizing its currency and implementing monetary reform on a larger scale. For many years, China has worked hard to establish the yuan as a primary world currency.

Indian Rupee payments have long been accepted and exchanged in trade among many foreign countries. For instance, the INR was widely used in Kuwait, Bahrain, Iran, Qatar and the UAE in the 1960s. Within South Asia, Bangladesh, Nepal and Bhutan have endorsed the Indian rupee as a means of financial settlement.

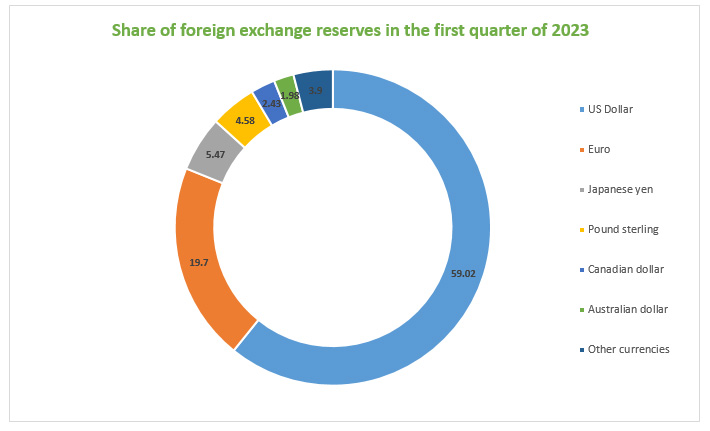

According to Currency Composition of Official Foreign Exchange Reserves (COFER) data from the International Monetary Fund (IMF), the dollar held a 59.02 per cent share of the world’s foreign exchange reserves in the first quarter of 2023, followed by the Euro (19.7), Yen (5.47), Pound Sterling (4.85), Renminbi (2.58), Canadian dollar (2.43) and Australian dollar (1.98). India’s share is trivial.

India has enjoyed relatively strong economic growth since it embarked on major structural reforms and economic liberalization in 1991. The average real GDP growth during 1991–2019 was 6.6 per cent. India is the third-largest economy after the US and China, accounting for around 7 per cent of global economic production (measured in terms of purchasing power parity). Despite recent shocks caused by COVID-19, the Russian–Ukrainian conflict and the worldwide increase in interest rates leading to an appreciation of the US dollar and widening of Current Account Deficits (CAD) in developing economies, financial institutions around the world continue to project India as the fastest-growing economy.

Economic Survey 2022–23 has a positive projection for FY24, with a growth potential in the 6.0 to 6.8 per cent range. The Survey notes that “India recovered from the pandemic quite quickly, and growth will be boosted in the upcoming year by strong domestic demand and an increase in capital expenditure”. Likewise, Kristalina Georgieva, Managing Director of IMF stated that India will alone account for 15 per cent of the global growth in 2023, maintaining its status as a relative “bright spot” in the global economy. Hence, this depicts India’s fundamental economic resilience and its capacity to re-energise the economy’s growth sooner.

The survey importantly highlights how inflation and monetary tightening caused bond yields to rise across nations and caused capital to move out of the majority of global economies and into the historically safe-haven US market. As a result of this sudden capital flight, the US dollar index rose 16.1 per cent against other currencies.

There are two reasons why India has taken the step to internationalize its currency seriously. The strength of the US currency in the past year has posed a challenge for many developing nations, including India. According to experts, this action might improve India’s trade with South Asian nations like Bangladesh and Sri Lanka, which are also struggling with dollar shortages. Two, trading in INR may boost India’s trade with countries under global sanctions. In the aftermath of the Russian invasion of Ukraine, Western nations implemented substantial trade sanctions against Russia. In contrast, India proactively explored avenues to augment its acquisition of crude oil from Russia. As a result, Russia has now ascended to the position of India’s principal oil supplier, supplanting traditional stakeholders such as Iraq, Saudi Arabia and the UAE.

With the implementation of the mechanism for rupee settlements in international trade by the Reserve Bank of India (RBI) in July 2022, Indian importers can make payments in rupee that will be transferred to a Special Rupee Vostro Accounts (SRVA) of the respective bank of the destination country, and Indian exporters will be paid from the balances in the designated Vostro accounts. The excess rupee balance in the Vostro accounts can be used to manage export-import transactions and payments for projects and investments.

Currently, Vostro accounts have been opened in Russia, Sri Lanka and Mauritius. A rupee-dirham payment system with Saudi Arabia and the UAE is expected to be started in August 2023. According to reports, more than 18 nations have expressed interest in having their trade settlements in rupees, and talks are currently being held with the central banks of Tajikistan, Cuba, Luxembourg and Sudan.

Adding momentum to the ongoing debate, in March 2023, the Indian government launched the Foreign Trade Policy (FTP). The FTP promises to increase the country’s share in the global supply chain in exports by promoting Cross Border Trade in Digital Economy and creating E-Commerce Export Hubs (ECEHs) across the country. Most importantly, the policy enables rupee-based invoices for imports and exports, and trade settlement using SRVA. The RBI made regulations permitting banking arrangements for invoicing, payment and settlement of exports and imports in INR.

The benefit of using the Indian rupee more frequently in overseas transactions would be significant for the Indian economy, which is among the top five economies in the world today. The Economic Survey of 2023 asserted that international trade in INR would help in protecting it from volatility and reduce the cost of doing business.

Additionally, it would lessen the requirement to have foreign exchange reserves. It would consequently reduce the economy’s susceptibility to abrupt downturns and changes in capital flow. There will be more opportunities to use the rupee in foreign transactions as the Indian economy expands and its economic ties with other nations strengthen. Finally, the bargaining power of Indian firms would increase as the rupee’s utilization grows in importance, supporting the Indian economy and raising India’s standing and esteem abroad.

While the above-mentioned are some of the conscious efforts made by the Indian government, it is equally important to examine the other side of the coin too.

One, the scale of the economy is crucial for internationalizing the INR. Although the Indian economy meets this requirement partially, it is still a trade deficit country. In other words, India imports more goods than it exports. India’s share of global commercial services exports was a mere 4.4 per cent in 2022. The low export market share decreases the need for other nations to keep their currency. For the same reason, Russia has been reluctant to conduct INR trade with India.

Two, elimination of all capital account restrictions is a sine qua non for the rupee to become an international currency. The proposal for a roadmap for full convertibility was initiated in 1997 with the formation of Committee on Capital Account Convertibility (CAC) or Tarapore Committee by the RBI. The 1997 and 2006 Tarapore Committee findings outlined a route with a few requirements to accomplish convertibility. These include having a gross fiscal deficit of less than 3.5 per cent of GDP, an inflation rate of 3 per cent to 5 per cent over three years, an equivalent per capita income of developed nations, among others. These suggestions are relevant even today. India has made economic progress but still needs to comply with these requirements fully.

Three, compared to major economic blocs like the Euro Zone and China, which are currently working to internationalize their currencies for decades, Subhash Chandra Garg, former Finance and Economic Affairs Secretary, notes that India has a considerably smaller economy. He argues that “Indian exports would end up getting lesser US Dollars for the same amount of goods exported than the US Dollars the exporter would have got if it was denominated in the US Dollars.” Therefore, he emphasizes that any effort to make the INR a global trade and settlement currency at this juncture would be nothing short of a wild goose chase.

For the rupee to become a significant global reserve currency, India must offer the rest of the world sizable amounts of safe, readily available, and convertible assets that could be used as collateral in financial markets. This would necessitate a significant change in India’s policy direction. Promoting rupee invoices with different nations will be challenging in the current global environment of trade restrictions and geopolitical rivalry. T. Rabi Sankar, the RBI Deputy Governor, has rightly pointed out that if India wishes to become a significant economic power, these risks associated with the internationalization of INR are inevitable.

Regardless, the move by the Indian government and the RBI to encourage the use of the INR for transactions in foreign trade is a significant milestone for India. It might increase the value of the INR, improve the competitiveness of Indian exports, and lessen India’s reliance on the US currency. The truth is that the US dollar will continue to be the dominant currency for the foreseeable future, but in a few decades, it’s possible that the US might gradually begin to share power with other currencies too, including the INR.

Sneha M. is a Research Analyst in the South Asia Centre at Manohar Parrikar Institute for Defense Studies and Analyses (MP-IDSA), New Delhi

Views expressed are of the author and do not necessarily reflect the views of the Manohar Parrikar IDSA or of the Government of India.

The full version of this article first appeared in the Comments section of the website (www.idsa.in) of Manohar Parrikar Institute for Defense Studies and Analyses, New Delhi on August 24, 2023