Through the first nine months of 2021, America’s deficit with China totaled $255.4 billion, an increase of 14.9% over the same period in 2020

Our Bureau

New York

All is not good on the economy front. The problem is three-folds: trade deficit, inflation and supply chain issues. And there is bad news on all the fronts. The US trade deficit hit an all-time high of $80.9 billion in September as American exports fell sharply while imports, even with supply chain problems at American ports, continue to climb.

The September deficit topped the previous record of $73.2 billion set in June, the Commerce Department reported Thursday. The deficit is the gap between what the United States exports to the rest of the world and the imports it purchases from foreign nations.

In September, exports plunged 3% to $207.6 billion while imports rose 0.6% to $288.5 billion. Part of the weakness reflected a 15.5% drop in petroleum exports related to the drilling rig and refinery shutdowns during Hurricane Ida in the Gulf of Mexico. Economists expect that decline to reverse in coming months with petroleum production coming back on line.

The politically sensitive goods deficit with China shot up 15% in September to $36.5 billion. Through the first nine months of this year America’s deficit with China, the largest with any country, totaled $255.4 billion, an increase of 14.9% over the same period in 2020.

The overall trade deficit through September hit $638.6 billion, a 33.1% increase over the same period last year. That big jump reflects the surge in US demand for imports compares to last year when many parts of the economy were shut down because of the coronavirus.

In September, the deficit in goods rose to $98.2 billion, up a sharp 10% from the August deficit. The surplus in services, which covers such things as airline travel and financial services, rose 10.5% to $17.2 billion, still well below the levels seen before the pandemic hit. The surplus in services is expected to rise further as Covid-19 cases retreat and travel restrictions are eased.

The rising trade deficit subtracted 1.1 percentage points from growth in the July-September quarter, a period when the economy, as measured by the gross domestic product, slowed to an annual growth rate of just 2%, sharply lower than a GDP growth rate of 6.7% in the April-June period.

As Covid-19 cases retreat and the supply chain becomes untangled, the US trade deficit should start to improve in coming months although the improvement may be modest, economists say.

Recently, Federal Reserve chair Jerome Powell said that Americans should be prepared for the global supply chain to remain in crisis through 2022 — and that the central bank is preparing to deal with the attendant challenges for the US economy.

Speaking at a Bank for International Settlements-South African Reserve Bank centenary conference, Powell warned that “supply-side constraints have gotten worse” over the course of the pandemic, while the supply chain and economic risks are “clearly now to longer and more-persistent bottlenecks, and thus to higher inflation.”

Already, those bottlenecks have slowed international commerce to a crawl as shipping containers loaded with goods wait to be unloaded and experts advise making an early start on holiday shopping. In addition to packages taking longer to show up, consumers are likely also feeling the resulting inflation.

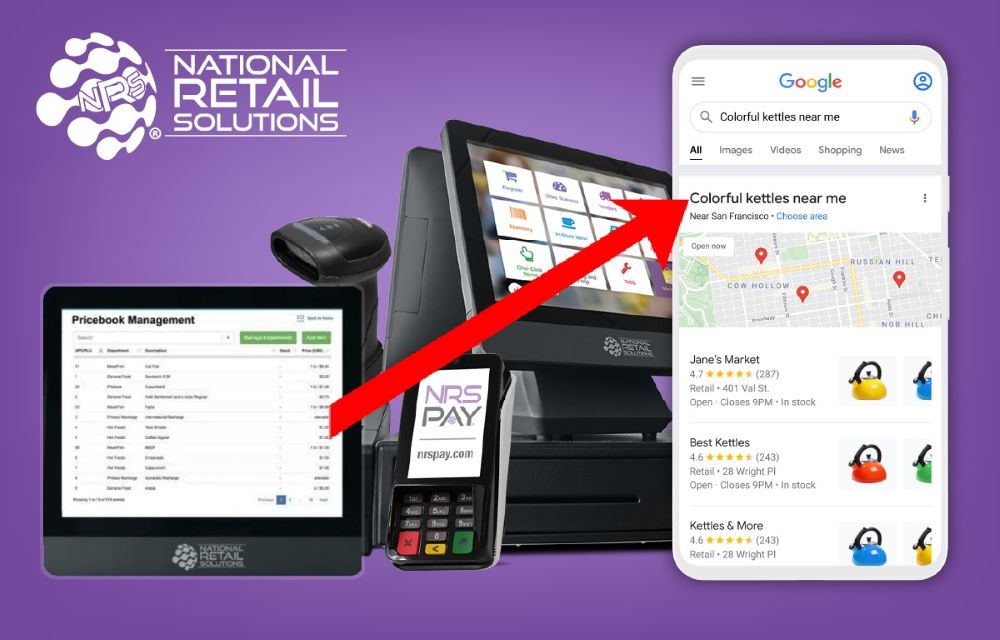

However, Americans’ appetite to consume hasn’t diminished. After a brief dip at the beginning of the pandemic, people have embraced both e-commerce and brick-and-mortar retail as pandemic restrictions have eased. That’s good for an economy blitzed by Covid-19, but it’s also created its own set of challenges in the form of a backed-up supply chain that wasn’t built to weather a pandemic, and accompanying inflation as people buoyed by an economic recovery keep spending.

For the policymakers, the challenge is to set the appropriate policy in response to developments, while businesses must decide how to incorporate inflationary developments into their business strategies. The task for both is unusually complex owing to the multiplicity of factors affecting inflation along with uncertainty about its drivers and their persistence. “Our view remains that much of what has driven inflation in recent months is temporary but is proving to be more persistent than anticipated. As a result, we have been raising our inflation forecast for a few months now as evidence accumulates that supply challenges are broader and more persistent that earlier assessed,” said an analyst.

The world may be slowly recovering from the pandemic, but its after effects may continue – even into the next year.