America’s hot-and-cold response to India’s Russian oil imports and the 50% tariff war reveals deep contradictions in U.S. strategy, exposing both geopolitical anxieties and economic pragmatism.

Our Bureau

New Delhi/Washington, DC

The U.S. relationship with India, often described as a “defining partnership of the 21st century,” is once again under strain. At the heart of the turbulence is New Delhi’s decision to continue importing Russian oil despite Western sanctions following the Ukraine war. While the U.S. has applauded India in recent years as a democratic counterweight to China, Washington’s latest moves—imposing 50% tariffs on Indian goods and publicly rebuking New Delhi—suggest a sharp recalibration. The oscillation between pressure and conciliation reflects both political calculations in Washington and India’s determination to safeguard its energy and trade interests.

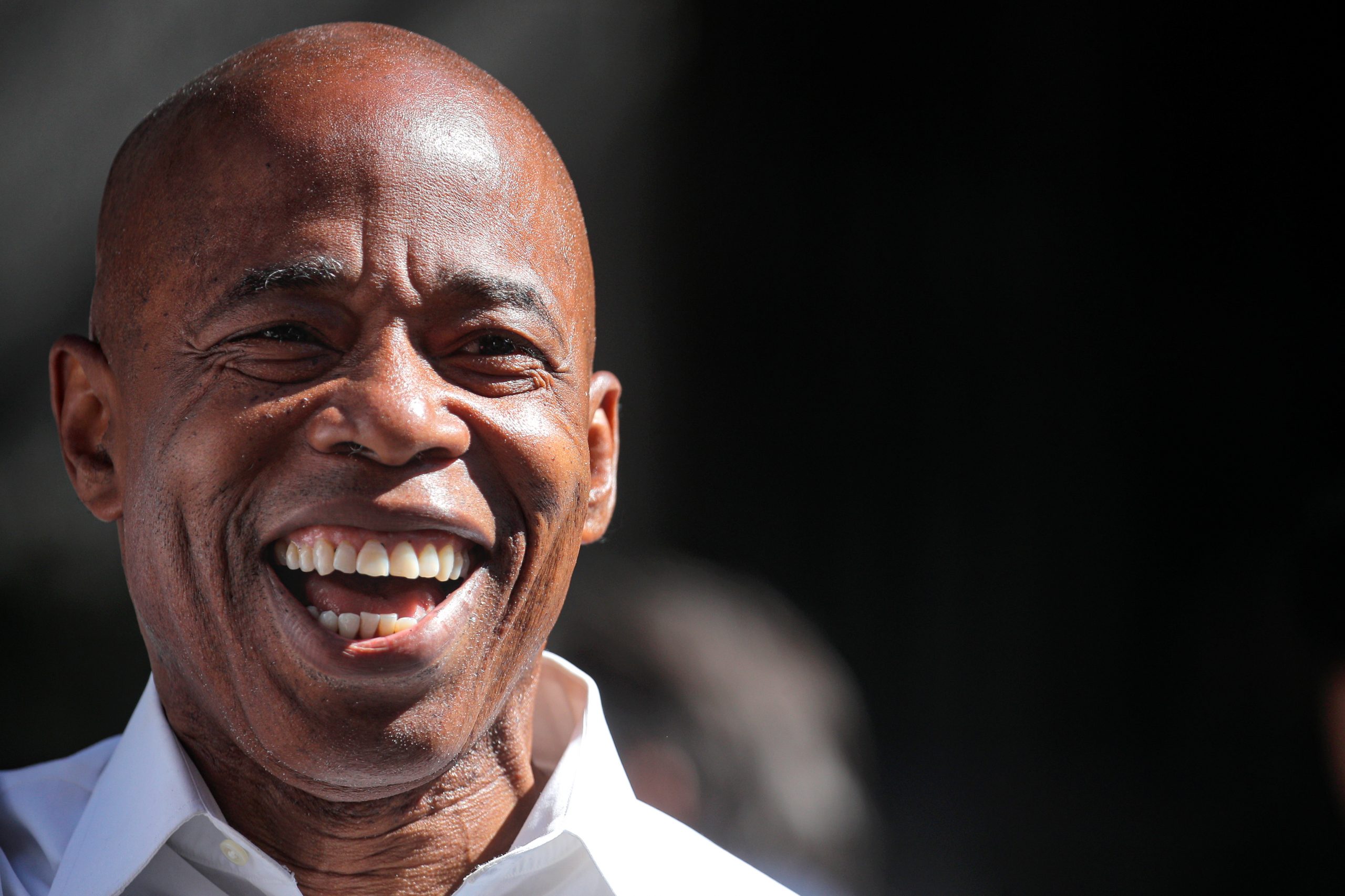

White House Trade Adviser Peter Navarro’s blunt criticism this week epitomizes Washington’s frustration. He accused India of “indirectly funding Russia’s war machine” and urged New Delhi to “act like a democracy” by siding with the West. His remarks followed the Trump administration’s decision to double tariffs on Indian goods, citing India’s Russian oil purchases as justification.

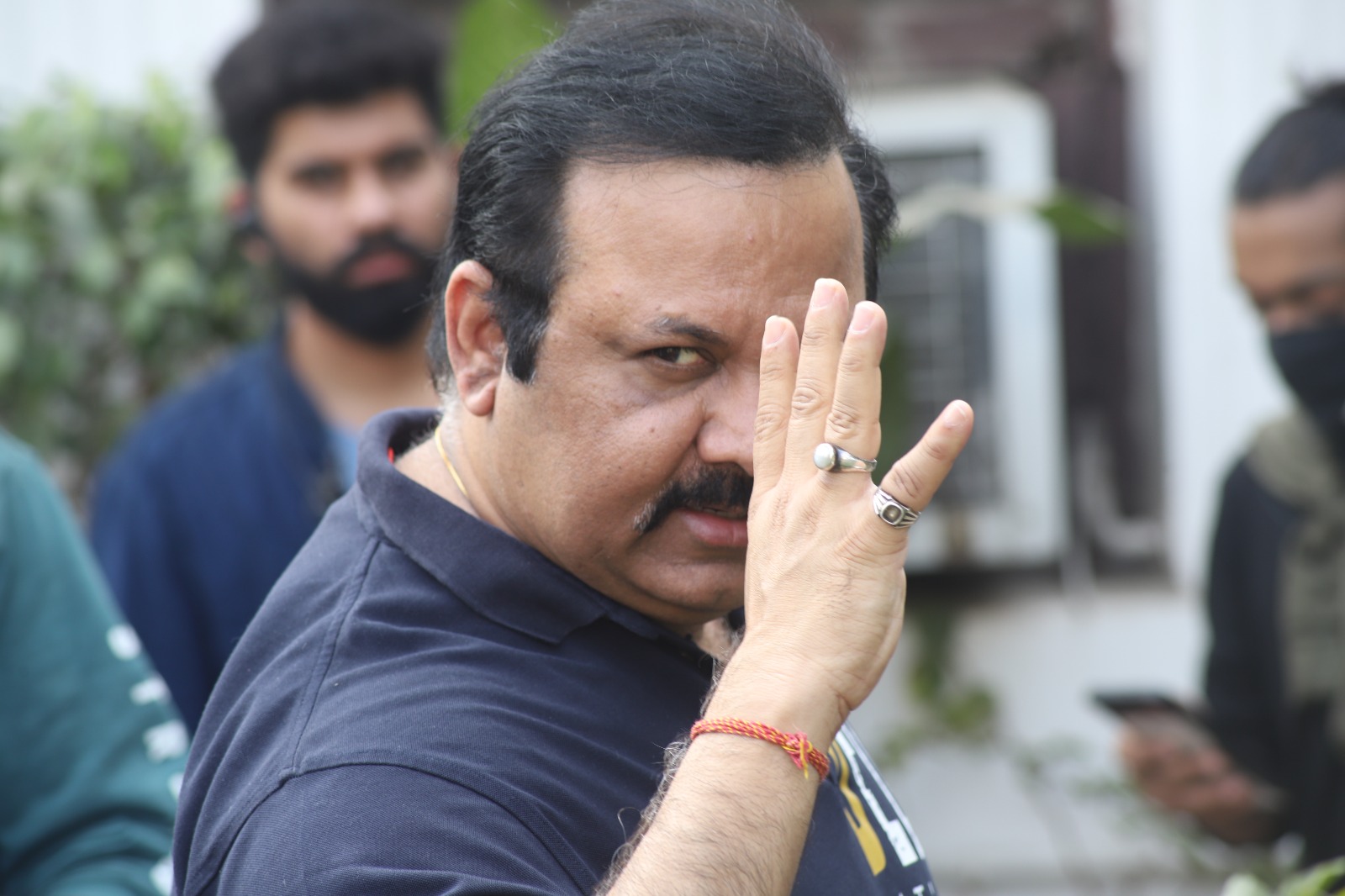

Yet this pressure sits uneasily with reality. India argues that it has not breached sanctions, and that its purchases are vital to stabilizing global energy markets. External Affairs Minister S. Jaishankar reminded critics that Washington itself once encouraged India to buy discounted Russian oil to ease supply shocks. From New Delhi’s standpoint, it is being unfairly singled out, particularly when European nations continue importing Russian commodities through indirect routes.

Democrats on the House Foreign Affairs Committee openly questioned why India alone faces such punitive tariffs while China—by far the largest buyer of Russian oil—escapes similar treatment. Their statement that the policy “hurts Americans and sabotages the U.S.-India relationship” highlights the contradiction: punishing India risks damaging a key strategic partnership while failing to constrain Russia’s revenues.

The mixed messaging from U.S. officials illustrates competing priorities. On one side are hawks like Senator Lindsey Graham, who framed India’s oil imports as morally complicit in civilian deaths in Ukraine, warning that countries buying Russian oil will “face consequences.” On the other side, Treasury Secretary Scott Bessent struck a conciliatory tone, expressing optimism about resolving tensions and praising the personal rapport between Trump and Prime Minister Narendra Modi.

This divergence reflects a deeper strategic tension. Washington wants India as both a trade partner and a geopolitical ally in balancing China, but it also demands compliance with its sanctions regime against Moscow. By oscillating between punitive tariffs and reassurances of partnership, the U.S. risks appearing inconsistent, even opportunistic.

For New Delhi, the equation is clear: access to affordable energy and protection of domestic producers outweigh U.S. pressure. Jaishankar bluntly described Washington’s tariffs as “unjustified and unreasonable,” stressing that India will defend its farmers and small manufacturers. Commerce Ministry officials acknowledge short-term pain in sectors like textiles and chemicals but insist the long-term impact will be limited.

India’s defiance is not merely economic—it is geopolitical signaling. By refusing to bend, New Delhi asserts its strategic autonomy, reminding Washington that it will not be a passive ally. Its growing energy ties with Russia, and even cautious engagement with China on multilateral platforms, reinforce this posture.

At its core, Washington’s vacillation stems from three competing impulses. First is geopolitical urgency—pressuring partners to cut off Moscow’s revenue streams. Second is domestic politics—Trump’s protectionist tariffs play well to certain voter blocs, even if they disrupt supply chains. Third is strategic necessity—the U.S. cannot afford to alienate India, a critical partner in countering Chinese influence in Asia.

Thus, America blows hot when Indian actions appear to undercut its sanctions, and cold when the costs of alienating New Delhi become apparent. This explains why Navarro and Graham lash out, while Bessent emphasizes eventual reconciliation.

Despite the noise, both sides are unlikely to allow the dispute to spiral into a rupture. India remains a vital market for U.S. companies, and Washington values New Delhi’s role in the Indo-Pacific. As Bessent noted, “at the end of the day, we will come together.” Yet the episode underscores the fragility of the partnership.

For India, the lesson is that U.S. goodwill can quickly turn coercive when Washington’s broader geopolitical agenda is at stake. For America, the risk is that by treating India differently from China or Turkey, it undermines both its moral argument and its credibility as a consistent partner.

As global energy flows shift and the Ukraine war drags on, this cycle of pressure and accommodation may repeat. For now, Washington’s hot-and-cold treatment of India reveals less about New Delhi’s choices and more about America’s struggle to reconcile values, strategy, and domestic politics.