Our Bureau

New Delhi

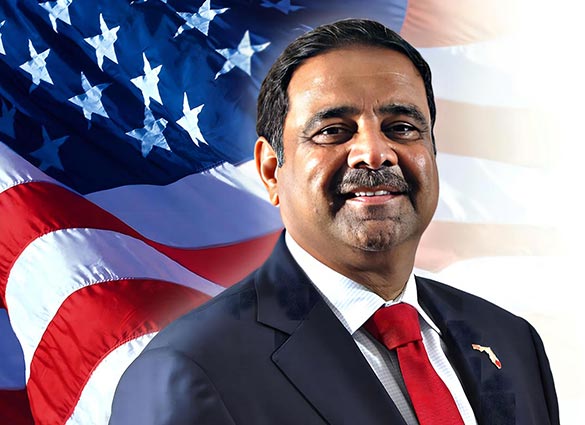

Digvijay “Danny” Gaekwad is a 65-year-old, US-based businessman of Indian origin. He was born in Vadodara, India, and moved to the United States in 1987. Gaekwad is known for his serial entrepreneurship across various sectors, including retail, real estate, hospitality, IT, and financial services.

Recently, he has emerged as a competitor to the Burman family in their bid for a controlling stake in Religare Enterprises Ltd (REL). Gaekwad initially proposed an open offer for 26% of Religare’s equity at ₹275 per share, which is a 17% premium over the Burman family’s bid of ₹235 per share. He later revised his offer to 55% of the company’s equity on 26 January.

Gaekwad’s interest in Religare aligns with his financial philosophy of creating value for stakeholders rather than seeking personal profit. He believes that Religare presents significant hidden value and potential for transformation.

As per the Burman family, Gaekwad has not formally made the open offer but has just sought Securities and Exchange Board of India’s (SEBI) permission make an offer.

These events follow Religare Enterprises’ December 10, 2024, announcement that the Burman family was authorized by the Reserve Bank of India (RBI) to increase its ownership stake in the company.

By March 31, 2026, the Religare Group and the Burman family are required to consolidate their non-banking financial companies (NBFCs) under a single organization.

This came after roughly a year of intense competition between the Burman family of Dabur India, which has progressively raised its ownership of the company over the previous five years, and Rashmi Saluja-led Religare.

Over the last decade, Gaekwad has been watching India’s economic growth with keen interest, particularly after Narendra Modi became the Prime Minister of India.

As per Gaekwad, India has high growth potential and in particular, Religare offers substantial hidden value. Its acquisition is a strategic move aimed to create value for the stakeholders as he has the knack for identifying undervalued assets and turning them into high-value investments.

Danny Gaekwad Developments & Investments has asked the regulator to allow the US-based company to submit a competing open offer in a letter sent to the SEBI Chairperson and posted by REL.

Gaekwad, a first-generation American entrepreneur and community leader based in Ocala, Florida came to the US in 1987 to pursue the “American Dream” with his wife, Manisha. The Vadodara native is the grandson of an Indian Army colonel and the son of a judge, according to his personal website. He received his political science degree from Baroda’s Maharaja Sayajirao University.

He has established more than a dozen small and medium-sized businesses over the past thirty years, including restaurants, hotels, real estate development, convenience stores, and IT consulting firms both domestically and abroad.

According to his website, Gaekwad currently owns over a dozen properties in the hospitality industry, including high-end brands like Hilton, and Intercontinental Hotel Group.

He has been supporting Trump and has been active in the Republican Party for more than 30 years.