Chief economic advisor V Anantha Nageswaran says the Indian economy is likely to grow at 6.5% in the current fiscal despite deficient monsoon rainfall

Our Bureau

Mumbai/New Delhi

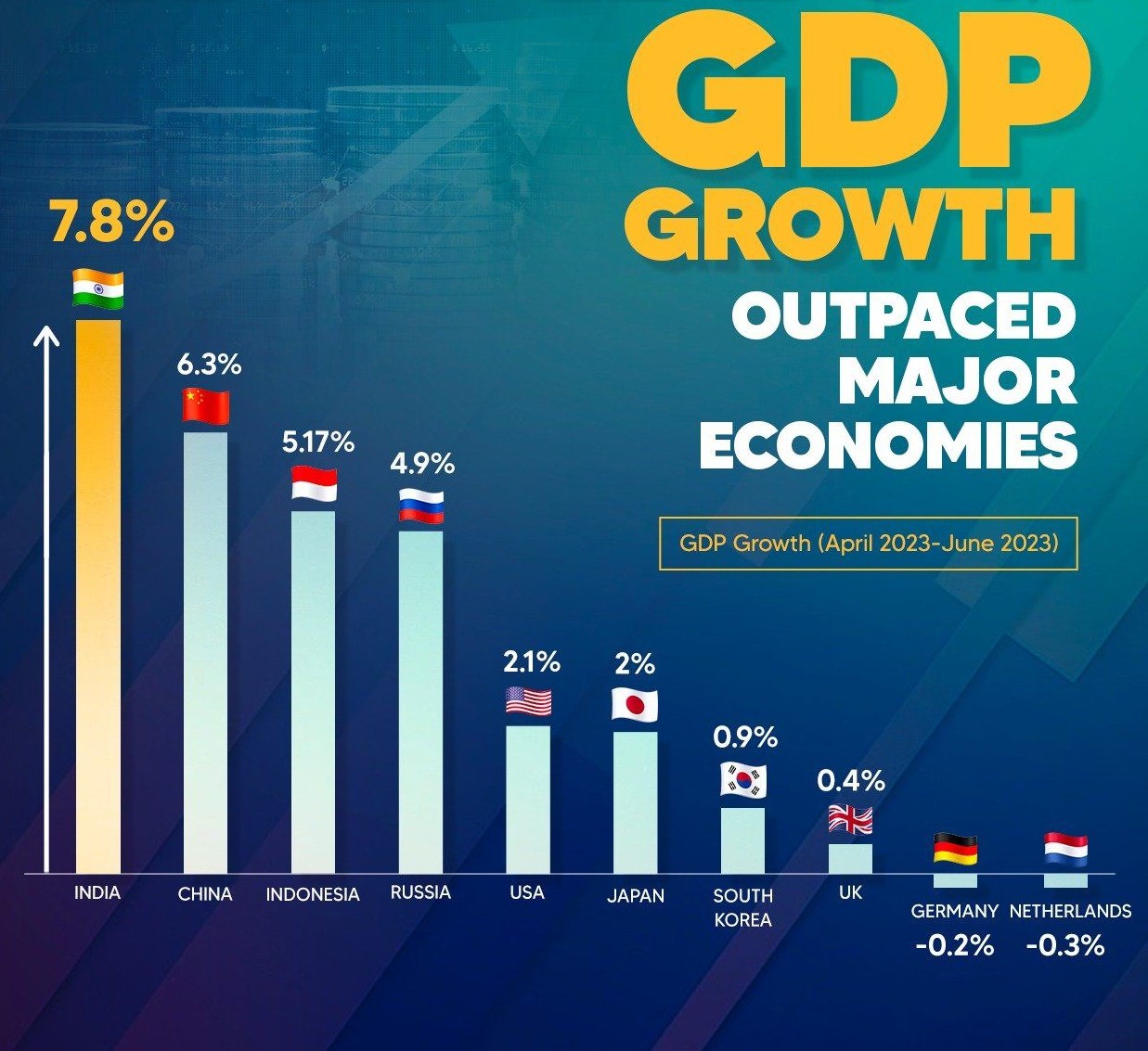

India saw a Gross Domestic Product (GDP) growth rate of 7.8 per cent in the first quarter (April-June) of 2023-24. Real GDP or GDP at constant (2011-12) prices in Q1 2023-24 is estimated to attain a level of Rs 40.37 lakh crore, as against Rs 37.44 lakh crore in Q1 2022-23, showing a growth of 7.8 per cent as compared to 13.1 per cent in Q1 2022-23, Ministry of Statistics and Programme Implementation said on Thursday.

With a GDP growth of 7.8 per cent, India continues to be the fastest-growing major economy. China’s economy grew by 6.3 per cent year-on-year in the second quarter of 2023.

According to data released by the Ministry, the agriculture sector recorded a 3.5 per cent growth, which is up from 2.4 per cent in the same quarter of last fiscal. However, the growth in the manufacturing sector decelerated to 4.7 per cent in the first quarter of the current fiscal compared to 6.1 per cent in the year-ago period.

Nominal GDP or GDP at Current Prices in Q1 2023-24 is estimated at Rs 70.67 lakh crore, as against Rs 65.42 lakh crore in Q1 2022-23, showing a growth of 8 per cent as compared to 27.7 per cent in Q1 2022-23, the Ministry added.

The quarterly estimates of GDP are indicator-based and are compiled using the benchmark-indicator method, i.e., quarterly estimates available for the previous year referred to as the benchmark year are extrapolated using the relevant indicators reflecting the performance of sectors.

The data sourced from various ministries, departments, and private agencies serve as valuable inputs in the compilation of the estimates.

The quarterly GDP estimates for July-September, 2023 (Q2 2023-24) will be released on November 30.

Meanwhile, chief economic advisor V Anantha Nageswaran said on Thursday that the Indian economy is likely to grow at 6.5% in the current fiscal despite deficient monsoon rainfall. “There is no real cause for concern that inflation would spike out of control as both the government and the Reserve Bank are taking adequate steps to maintain supply and keep prices under check, reported PTI quoting the chief economic advisor.

Nageswaran said the food inflation is likely to subside with the arrival of fresh stock and government measures. However, he said the impact of deficient rains in August is to be watched.

“There is momentum in economic activity in general and it is not driven by price-related distortions. Therefore, our projections still are very comfortably placed at 6.5 per cent for the current financial year,” Nageswaran said.

Risk is evenly distributed to around 6.5% growth projection for FY2023-24, he said while briefing media following the release of first quarter GDP numbers, he said. “Rising crude prices may warrant attention and prolonged geopolitical uncertainty and likely tighter financial conditions can pose risk to growth,” The chief economic advisor added.

With regard to fiscal deficit, Nageswaran said there is no threat to 5.9% fiscal deficit announced in the Budget.

Recently, S&P Global Market Intelligence has revised the global real GDP growth forecast for 2023 to 2.5 per cent, primarily owing to upward revisions in the US forecast. Earlier, it had predicted global growth at 2.4 per cent.

However, the 2024 global growth forecast is kept unchanged at 2.4 per cent.

Turning the focus to India, it said the country’s economy is continuing to show rapid expansion, with GDP growth expected to remain robust in the near term, at a pace of 5.9 per cent in the financial year 2023 and 6.1 per cent in the next.

“However, a renewed upturn in inflation pressures in mid-2023 due to rapidly rising food prices has pushed CPI inflation back above the upper end of the Reserve Bank of India’s inflation target range,” Rajiv Biswas, APAC Chief Economist at S&P Global Market Intelligence said.

“Although inflationary pressures have moderated since the beginning of 2023 in a number of Southeast Asian countries, the downside risk of a severe El Nino weather event remains a key uncertainty for the near-term economic outlook,” Biswas added.