For Chauhan, an IIT and IIM alumnus, this will be a homecoming of sorts, as he was part of the team that set up the NSE. He started his career at IDBI Bank, before moving to the NSE.

Our Bureau

Mumbai

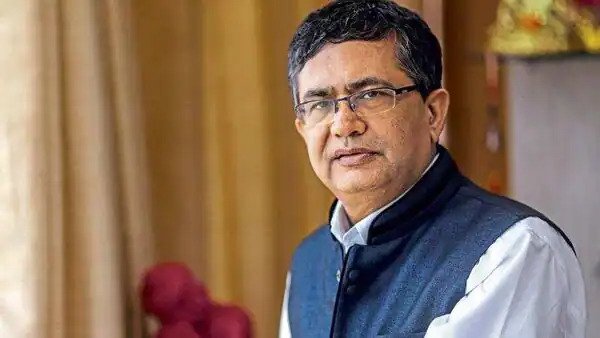

SEBI has approved appointment of Ashish Chauhan as the new CEO of National Stock Exchange (NSE). Currently Ashish Kumar Chauhan is MD & CEO of the Bombay Stock Exchange (BSE). The five-year tenure for Ashish Chauhan ends in November this year. It is understood that BSE has started the process to select a new chief.

Popularly known as the father of modern financial derivatives, Ashish Chauhan was one of the founders of NSE. Chauhan has worked at NSE between 1992 and 2000. His contribution in setting up India’s first fully automated screen-based trading system and first commercial satellite communications network is well recognised by the industry. He is also credited with creation of several frameworks including Nifty index and NSE certifications in financial markets. Chauhan has worked as the president and Chief Information Offer (CIO) of Reliance Group from 2000 to 2009.

Chauhan will be replacing Vikram Limaye who joined NSE in 2017. Vikram Limaye has shown no interest in continuing to head NSE even though he has an option to lead NSE for another five years. Limaye’s five-year tenure ended on July 16. Now NSE will have to take shareholders’ approval to appoint Ashish Chauhan even as four-member internal panel has been set to oversee the responsibilities of MD & CEO till the new person takes charge.

NSE has been facing tough times lately owing to co-location facility issue. Market participants will be watching closely the new developments at NSE with the change in the leadership.

It remains to be seen if Chauhan joins the NSE immediately or after the completion of his full tenure at the BSE. Chauhan is likely to get an initial tenure of five years at the NSE.

For Chauhan, an IIT and IIM alumnus, this will be a homecoming of sorts, as he was part of the team that set up the NSE. He started his career at IDBI Bank, before moving to the NSE. Between 1993 and 2000, Chauhan worked extensively in developing the derivatives segment at the NSE, which currently is the exchange’s main volume driver.

Chauhan also has experience outside the financial sphere. He had worked as CEO of Mukesh Ambani-led IPL cricket team Mumbai Indians in its formative years and also worked as president and CIO of Reliance group between 2000 and 2009.

Chauhan’s key challenge would be to not get too bogged down by the legacy regulatory issues and to ensure that NSE maintains its dominance, say industry players.

The NSE has nearly a monopoly in the equity derivatives segment, while in the cash segment, it has more than 90 per cent market share. The BSE has lost market share in the equity cash segment to the NSE from 17 per cent in FY17 to below 8 per cent in FY22. Since the Covid pandemic, trading volumes, revenue growth, and profitability at the NSE have sky-rocketed due to the surge in the markets and a spurt in new investors.

During Limaye’s tenure, the NSE’s revenue grew at a compound annual growth rate (CAGR) of 26 per cent to Rs 8,500 crore between FY17 and FY22, while net profit jumped at 29 per cent CAGR to Rs 4,400 crore. Maintaining this growth rate will be a tall ask, more so if the current market downturn continues.

Chauhan will also have to oversee the launch of the proposed ‘connect’ between the NSE and the SGX to ensure all the Nifty trades happening on the Singapore bourse get routed through the GIFT City IFSC.

A feather in Chauhan’s cap will be if the NSE is able to push through with its initial public offering (IPO), which has been stuck due to the exchange’s regulatory troubles.