By doubling tariffs on Indian goods to 50%, Donald Trump is gambling that economic pressure will force New Delhi to curb Russian oil imports — but Narendra Modi is standing his ground, backed by farmers, a chorus of domestic support, and even some opposition voices critical of Washington’s move

Our Bureau

New Delhi | Washington, DC

When Donald Trump signed an executive order on August 6 imposing an additional 25 percentage points in tariffs on Indian goods — taking the total levy to 50% — it was more than a trade measure. It was a calculated gamble aimed at reshaping U.S.–India relations under intense geopolitical strain. Washington’s stated concern: India’s continued imports of Russian oil, which the order claims present an “unusual and extraordinary threat” to the United States.

The timing was designed to sting. The first 25% tariff had only just taken effect on August 7; the second tranche is set to follow within 21 days, covering all Indian goods entering U.S. ports, with only narrow exemptions. Trump’s Oval Office comment was blunt: there would be no trade talks “until we get it resolved.”

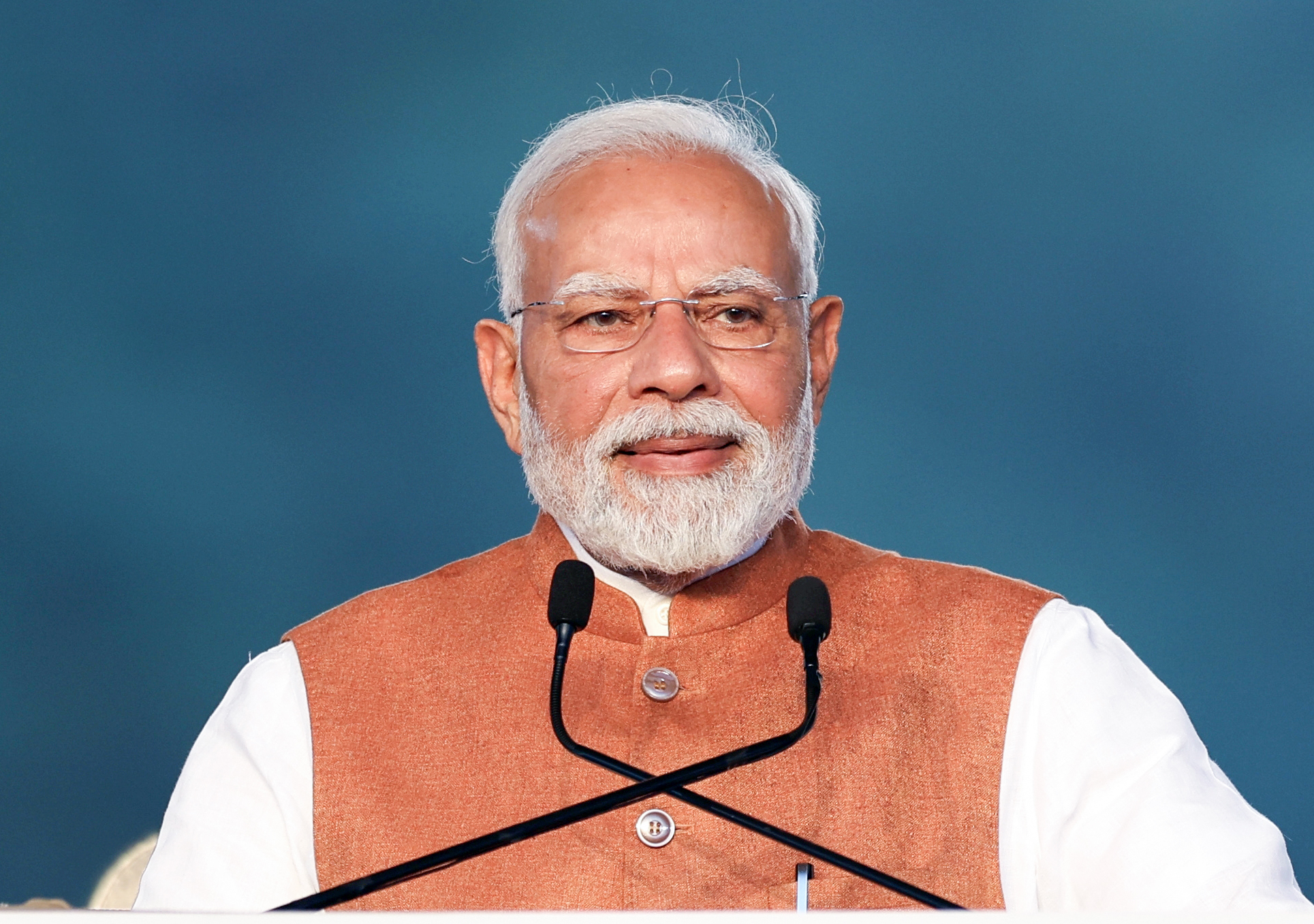

For India’s Prime Minister Narendra Modi, this was no time to retreat. Standing before an audience at the MS Swaminathan Centenary International Conference, he issued a defiant message that was as much for Washington as for his domestic base: “India will never compromise on the interests of farmers, fishermen, and dairy farmers. I know we will have to pay a heavy price for it, and I am ready for it. India is ready for it.”

The statement tapped directly into a deep reservoir of domestic sentiment. Modi’s refusal to open agriculture and dairy markets to U.S. competition has long been rooted in the political reality of rural India, where millions depend on these sectors. Trump’s tariffs, by targeting sensitive export categories, seem designed to test Modi’s resolve. Instead, they appear to have fortified it.

Domestic Rally Around Modi

Across India, farmers responded with visible solidarity. From Uttar Pradesh to Haryana to Rajasthan, voices in local media praised the Prime Minister’s stand, pointing to schemes like PM-Kisan Samman Nidhi and improved crop prices. “What PM Modi has done for the farmers, no one could ever do,” one farmer told ANI. “We will keep standing with him.”

The Bharatiya Janata Party’s own MPs amplified the message. Nishikant Dubey called on “140 crore Indians” to back Modi in the face of Trump’s “attack” and portrayed the moment as a test of national unity. By reframing the dispute as a patriotic duty, the BJP has effectively insulated Modi from domestic political fallout — at least in the short term.

Opposition’s Mixed Messages

Trump’s tariff escalation has also created unexpected political alignments. While opposition leaders remain critical of Modi, several have aimed their fire at Washington.

Shashi Tharoor argued India should “match” the U.S. tariffs, raising duties on American goods to 50%. “It is not that any country can threaten us like this,” he said, making a sovereignty-based argument that resonates beyond party lines.

Independent MP Pappu Yadav went further, warning of a “collapse” in India’s pharmaceutical exports and urging Modi to stop generic medicine supplies to the U.S. entirely.

Others, like Congress MP Karti Chidambaram, saw the tariffs as proof that Modi’s much-touted “special relationship” with Trump never existed. Rahul Gandhi, meanwhile, claimed Modi’s “hands are tied” due to alleged links between his government, industrialists like Adani, and Russian oil deals — a charge the BJP has dismissed as political theatre.

Washington’s Balancing Act

For the Biden-era State Department, this dispute would have triggered diplomatic firefighting. Under Trump, the approach is more confrontational — but still tempered by the language of partnership.

“India is a strategic partner,” State Department spokesperson Tommy Pigott told reporters, promising “full and frank dialogue” despite the tensions. In Washington’s framing, the tariffs are leverage, not a break. Yet Trump has also warned that other BRICS members — including China — could face similar measures if they “align with anti-American policies.”

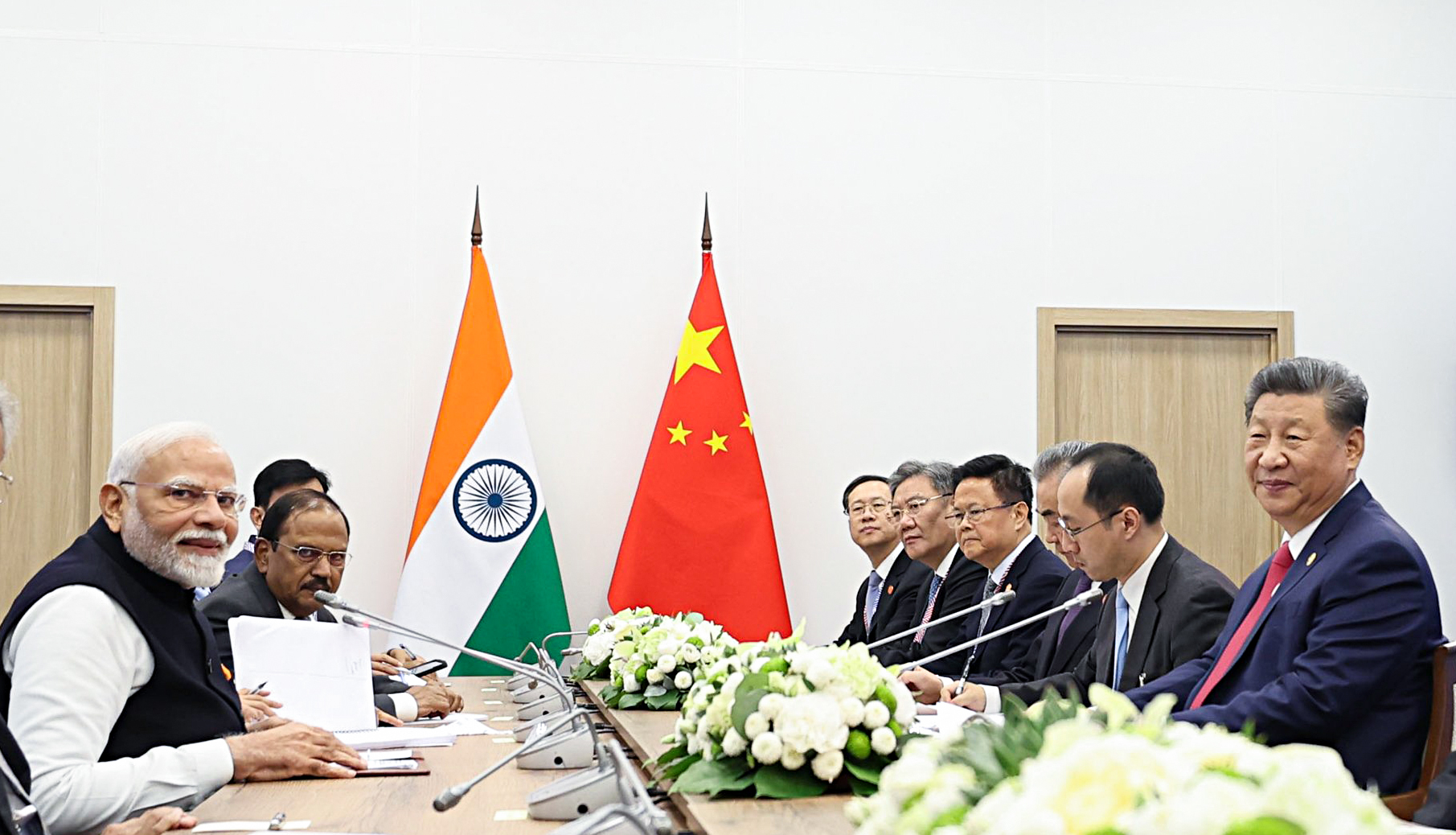

That threat comes as BRICS cohesion is already being tested. Modi’s upcoming visit to China for the Shanghai Cooperation Organisation summit will be his first in over seven years. Russian President Vladimir Putin is also expected in New Delhi later this year, with strategic and defence ties high on the agenda.

Trump’s tariff strike could, unintentionally, push India closer to its BRICS partners at a time when Washington wants the opposite.

Economic Stakes

The immediate economic fallout is clear: higher costs for Indian goods in the U.S. market and pressure on key export sectors like pharmaceuticals, textiles, and engineering goods. Tharoor’s warning about the $90 billion bilateral trade volume underscores the risk of a mutually damaging spiral.

Yet India’s calculus is strategic. Oil imports from Russia have become a critical pillar of its energy security, especially after discounts following the Ukraine war. New Delhi insists purchases are “based on market factors” and designed to meet the needs of 1.4 billion citizens. The Ministry of External Affairs has called the U.S. tariffs “unfair, unjustified and unreasonable,” vowing to take “all actions necessary to protect national interests.”

In trade terms, India’s average tariffs on U.S. goods are about 17% — a figure Tharoor and others suggest could be weaponised in retaliation. This hints at the possibility of a full-blown trade war, something both economies can ill afford but neither side currently rules out.

Strategic Risk for Trump

Trump’s political calculus is risky. The U.S.–India relationship has, for two decades, been nurtured as a bipartisan strategic priority in Washington, framed as a counterbalance to China’s rise. Even amid disputes over visas, defence procurement, and WTO cases, the trajectory has been toward deeper alignment.

By turning a core strategic partner into a tariff target, Trump is betting that economic pain will force political concessions from Modi — without triggering a pivot toward Beijing or Moscow. But with Modi preparing to meet both Xi Jinping and Putin in the coming months, and with BRICS exploring non-dollar trade settlements, the risk of accelerated strategic drift is real.

If Trump’s strategy is to pressure Modi through domestic opinion, early signs suggest it is misfiring. The Prime Minister’s defiant stance plays well with his core narrative of national strength and sovereignty. Framing the tariffs as an attack on Indian farmers resonates in both rural and urban constituencies.

Even some opposition critiques of Trump — though often coupled with attacks on Modi — reinforce the perception that the U.S. move is overreach. This shared indignation limits Trump’s ability to exploit India’s political divisions.

Possible Off-Ramps

Both sides have tools to de-escalate. The U.S. order allows for modifications “depending on changing geopolitical circumstances” — leaving room for rollback if India makes gestures on oil imports or trade concessions in less sensitive sectors.

India, for its part, could use retaliatory tariffs as bargaining chips rather than blunt instruments, targeting politically sensitive U.S. exports without closing the door to negotiation. Diplomatic backchannels — which Chidambaram claims are absent — could still revive talks if both capitals see value in preserving the strategic partnership.

At stake is more than trade. U.S.–India relations are a central pillar of Washington’s Indo-Pacific strategy and a key element of New Delhi’s multi-alignment doctrine. A prolonged tariff war would not only damage economic ties but also erode trust, making cooperation on defence, technology, and regional security harder to sustain.

Trump’s gamble assumes Modi will bend. Modi’s response suggests he is prepared to absorb short-term economic costs to protect core political and strategic interests — and that the Indian public, for now, is prepared to back him.

Whether this standoff becomes a temporary flare-up or a defining rupture will depend on how deftly both leaders can navigate the months ahead. With U.S. elections looming and India deep in its own political cycle, the space for compromise is shrinking even as the stakes grow.