Our Bureau

Dubai

The Indian business community in Dubai has lauded the 2025 Union Budget, highlighting its visionary reforms aimed at stimulating economic growth and enhancing investment opportunities. Presented by Finance Minister Nirmala Sitharaman on February 1, 2025, the budget focuses on key sectors such as agriculture, small and medium enterprises (SMEs), and middle-class consumers, aligning with India’s long-term economic goals.

The budget introduces significant measures to boost consumer spending and investment across various sectors. Additionally, the government aims to enhance foreign direct investment (FDI) in the insurance sector, with plans to increase insurance penetration from 4% to global standards of 6-7% of GDP. The tax exemption limit has also been raised to Rs. 12 lakhs, which is anticipated to further stimulate economic activity.

A notable aspect of the budget is the allocation of Rs. 9,000 crore for a Credit Guarantee Scheme designed to support Indian startups. Many of these startups are expanding into the Gulf Cooperation Council (GCC) region, and this initiative is expected to foster growth in marketing and advertising sectors. Further, more focus on exports and digital commerce is expected to improve bilateral trade.

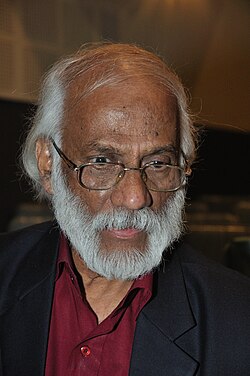

Sahitya Chaturvedi, Secretary General of the Indian Business and Professional Council (IBPC) in Dubai, emphasized that the budget aligns with India’s vision for 2047 while setting significant objectives for 2030. He pointed out that Indian exports in West Asia, particularly in electronics and textiles, are well-positioned for growth due to these reforms.

While many non-resident Indians (NRIs) in the Gulf welcomed the budget, provisions aimed at boosting trade between India and Gulf nations, some expressed concerns over insufficient tax relief measures. Bhavesh Talreja, CEO of Globale Media, noted that although there are opportunities for increased marketing investments due to higher disposable incomes, the lack of a reduction in GST on advertising services remains a missed opportunity.