Russia, therefore, needs reliable long-term partners to develop its Far Eastern regions and sustain its economy. Oil and Gas are sectors whose strength is vital for reviving the Russian economy, post the Ukraine crisis

Bipandeep Sharma

The Ukraine crisis has led many Western oil and gas companies to terminate their joint energy projects with Russia in the Arctic. This has been due to the fear of Western economic sanctions as well as to mark opposition against Russia for its military operation in Ukraine. Companies like BP, Equinor, ExxonMobil and Shell are some of the major energy giants that are in the process of finding suitable exits from Russian energy projects.

Sakhalin-1, which is an international consortium of oil and gas development companies in the Russian Far East, has started witnessing similar trends. The US energy giant, ExxonMobil, which owned 30 per cent stake in Sakhalin-1, has already stopped its operations and is expected to formally exit from this joint venture. The other entities in Sakhalin-1 are Sakhalin Oil & Gas Development Co. Ltd. (Japan), ONGC Videsh Ltd. (India) and Sakhalinmorneftegas-Shelf and RN-Astra (Russia). These companies hold 30 per cent, 20 per cent, 11.5 per cent and 8.5 per cent stakes respectively.

Similarly, Sakhalin-2 is an international energy development consortium of Gazprom (Russia), Shell (US-based subsidiary of Royal Dutch), Mitsui & Co. (Japan) and Mitsubishi Corp. (Japan). Shell, which holds 27.5 per cent stake in Sakhalin-2, has announced plans to exit this energy consortium. There were also reports that Japanese companies, Mitsui & Co. and Mitsubishi Corp., which hold 12.5 per cent and 10 per cent stakes in Sakhalin-2 respectively, were also under strong Western pressure to terminate their partnership with Russia. Though Japan has so far resisted this pressure owning to the country’s dire energy needs, uncertainty remains as to the future prospects of this cooperation.

Sakhalin-1 and Sakhalin-2 are Russia’s most important integrated oil and gas development projects that operate in one of the world’s harshest climatic conditions. The Sakhalin-1 is estimated to hold approximately 2.3 billion barrels of oil and 17.1 trillion cubic feet of gas reserves. Sakhalin 2 accounts for 4 per cent of the world’s total LNG supply. The region is prone to earthquakes and requires special technical expertise and engineering skills for exploration. Moreover, the development and operational costs of these projects is much higher.

Russia, therefore, needs reliable long-term partners to develop its Far Eastern regions and sustain its economy. Oil and Gas are sectors whose strength is vital for reviving the Russian economy, post the Ukraine crisis. If European and Western countries become successful in reducing their oil and gas dependency on Russia (which they intend to do so in near future), the most viable option for Russia is to tap energy markets in East, South East and South Asian countries. Sakhalin-1 and Sakhalin-2, therefore, can become the most promising projects for supplying Russian oil and gas to these markets.

India–Russia Energy equation

Oil and Gas trade between India and Russia remains significantly low, despite Russia being the world’s third largest producer and India being the third largest consumer. The most obvious reason for this pertains to the shipping distance, cargo delivery time and cost escalation as a result of long geographical distances between the two countries. India’s energy engagements with Russia, other than the direct purchase of oil and gas, is through ONGC Videsh Limited’s (OVL) direct investments in Russian energy projects.

Apart from Sakhalin-1, OVL holds 100 per cent stake in Russia’s Imperial Energy Corporation and 26 per cent stake in the Vankorneft field. Also, 23.9 per cent stake in Russia’s Vankorneft field and 29.9 per stake in the Taas-Yuryakh field, are jointly held by the consortium of Oil India Limited, Indian Oil Corporation and Bharat PetroResource Limited.

In the aftermath of the Ukraine crisis, Russia’s offer to supply India with cheaper crude oil (US$ 35 lesser than the international market price), was criticized by the West. Indian companies though significantly increased their volumes of oil imports from Russia. India’s total import of Russian oil despite buying additional volumes in March 2022, remained less than 1 per cent of its total oil import. These figures increased to 18 per cent in May, 2022 as per a report published by CREA.

The Western exit from Russian oil projects could become a big opportunity for Indian oil companies to directly invest in Russian energy projects to secure the country’s long-term energy needs. ExxonMobil’s decision to sell its 30 per cent stake from Sakhalin-1 needs to be carefully thought through, and India’s OVL could consider increasing its stakes in Sakhalin-1. Similarly, OVL or a joint consortium of companies led by OVL, could consider buying Shell’s 27.5 per cent stake that it intends to sell in Russia’s Sakhalin-2 project. OVL already maintains the technical expertise required for drilling in these harsh terrains. Therefore, such investments would significantly strengthen and diversify India’s energy supply chains and reduce the country’s dependency on Middle East countries for oil imports.

Strategic Calculus

Both Sakhalin-1 and Sakhalin-2 offer tremendous opportunities for India. Though there looms the current fear of Western economic sanctions and other technical shipping hindrances, India needs to pragmatically think through the long-term energy benefits from this region. Western exits from Sakhalin energy projects may negatively impact Russia economically, but it would simultaneously create investment voids, thereby giving a free hand to China to make long-term energy investments. China’s stakes in Sakhalin could enhance geopolitical disparities, owning to the presence of Japan and India as the other two partners in these projects. But, if India becomes successful in increasing its stakes in Sakhalin, it would not only benefit Indian oil refineries with high-grade sweet crude (especially Sokol grade form Sakhalin-1) to sustain domestic needs, but Indian oil companies could also process and can further sell Sakhalin crude and its derivatives to South East Asian, South Asian and even European markets.

An increase in energy investments in the Russian Far East would further enhance India–Russia naval cooperation and would significantly strengthen Indian naval presence in the Indo-Pacific. Indian oil shipments coming from the Russian Far East would also be free from piracy risks which remains a threat near the Horn of Africa. One may argue that in an adverse case scenario, China may put a blockade to Indian oil shipments coming from the Russian Far East. But a valid counter argument is the fact that it would be difficult for China to stop Russian oil shipments to India, given the China–Russia strategic partnership. Still, if ever the situation arises, India may also use similar leverage against China on its energy shipments passing through the Malacca Strait.

Shipping Factor and Distance Analysis

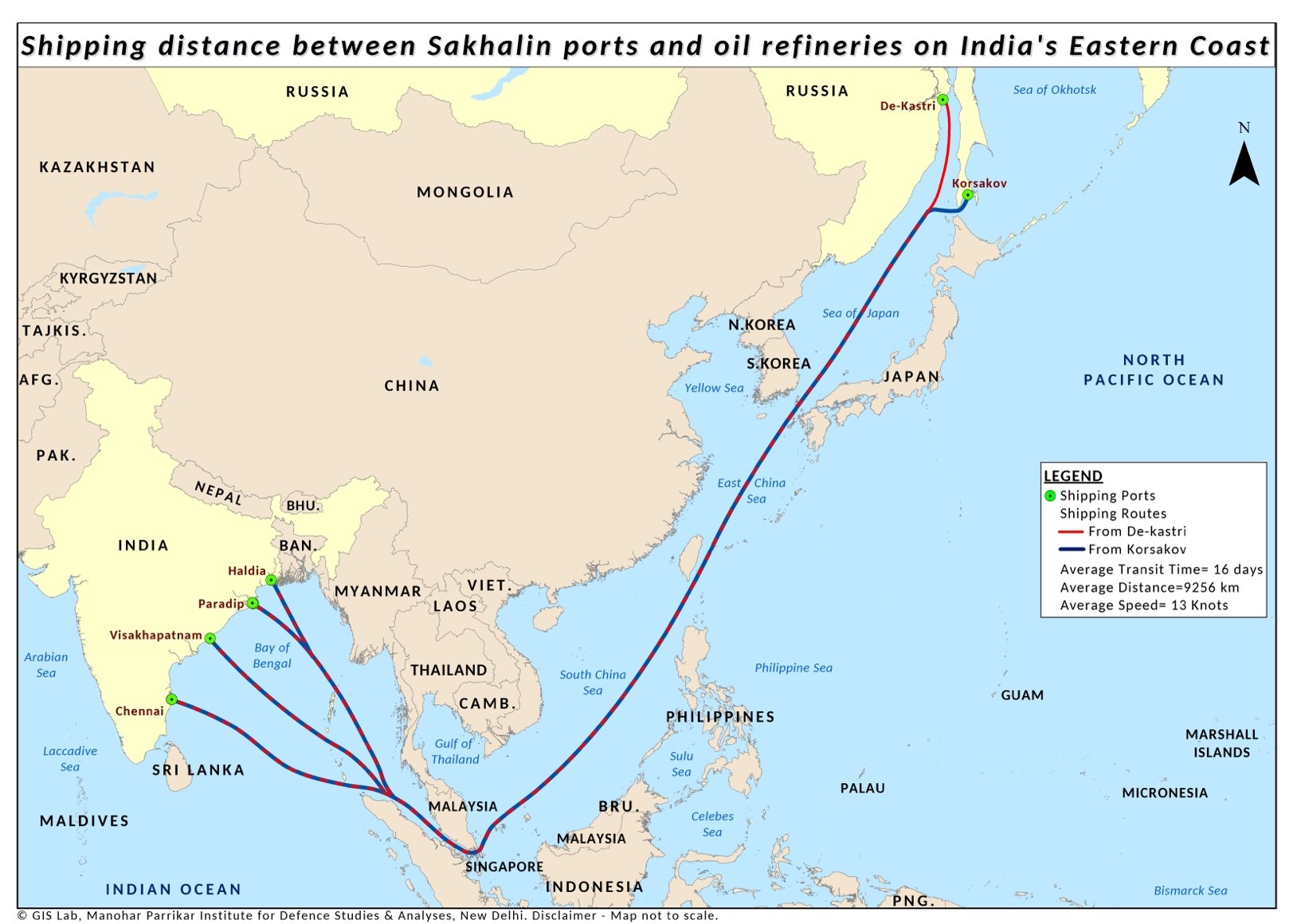

India has four major oil refineries located on its eastern coast. These include Haldia Refinery (West Bengal), Paradip Refinery (Odisha), Manali Refinery (Chennai) and Visakhapatnam Refinery (Andhra Pradesh). The shipping distance between Russia’s De-Kastri oil export terminal (Sakhalin-1) and Chennai Port is 9,626 km. It would take approximately 16 days and 15 hours for a large oil cargo ship to cover this distance, running at an average speed of 13 knots. Similarly, the average distance between Korsakov port (Sakhalin-2) and the Indian ports of Haldia, Chennai, Paradip and Visakhapatnam is around 9,256 km. At an average speed of 13 knots, it would take approximately 16 days for these oil shipments to reach all major Indian refineries on its eastern coast. This is a significant reduction in travel time as compared to Russian oil coming to India’s western coast from its Baltic Sea ports, for which average transit time is 23 days.

If we compare India’s oil shipments coming from US Gulf Coast to Mumbai port, the approximate transit time is 31 days and this further increases to 35–40 days, if the shipments need to reach Indian refineries on the country’s eastern ports. The only limitations that currently hinder enhancing India–Russia oil trade relate to payments, availability of shipping vessels and cargo insurances. Western sanctions on shipping companies and insurance providers are hindering the transportation of Russian crude to its required destinations. If India and Russia develop credible mechanisms to bypass Western economic sanctions or can find suitable alternatives complying with international norms, there remains immense potential for both the countries to cooperate in Sakhalin.

Conclusion

India in 2019 issued a US$ 1 billion line of credit for the development of the Russian Far East region. The government’s vision inclines well with the current emerging opportunities in Sakhalin. The government is in talks with state-run oil companies to consider increasing their stakes in Russian energy projects. Though the Middle East remains India’s most viable choice for energy imports, emerging geopolitics and shifting traditional alliances compels India to diversify its partners. Russia, with its abundant energy resources, coupled with the exit of Western oil companies from its energy projects, offers tremendous opportunity for India.

Bipandeep Sharma is a Research Analyst at the Manohar Parrikar Institute for Defense Studies and Analyses, New Delhi

Views expressed are of the author and do not necessarily reflect the views of the Manohar Parrikar IDSA or of the Government of India.

This is the abridged version of the Introduction of the book which appeared first in the Comment section of the website (www.idsa.in) of Manohar Parrikar Institute for Defense Studies and Analyses, New Delhi on June 21, 2022