From H-IB visa fees to Pakistan outreach and trade deal, Washington’s pressure tests India’s patience — yet New Delhi’s quiet confidence signals a more balanced relationship than ever before

Our Bureau

Washington, DC / New Delhi

President Donald Trump’s second term has entered a critical phase for India-U.S. relations. Despite the warmth of past public appearances and the symbolic gestures of friendship, the tone between Washington and New Delhi has grown noticeably sharper. The world’s two largest democracies are still aligned in principle on the need for a free Indo-Pacific and deeper trade and technology ties, but the road ahead has become bumpier. Trump’s brand of transactional diplomacy—part showmanship, part pressure politics—is once again testing the limits of India’s patience and pragmatism.

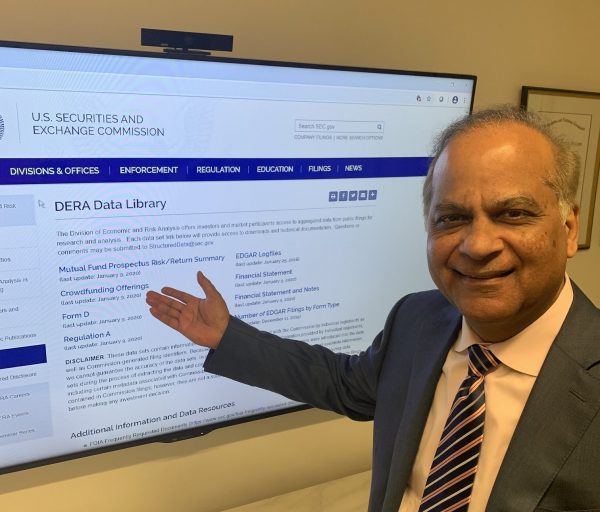

The latest flashpoint emerged when the administration imposed an extraordinary one-hundred-thousand-dollar fee on every H-1B visa petition, instantly sparking outrage across corporate America. The U.S. Chamber of Commerce, which rarely confronts the White House so directly, filed a lawsuit challenging the measure as unlawful. Neil Bradley, the Chamber’s Executive Vice President, warned that the fee would make it impossible for start-ups and smaller businesses to use the visa program and would cripple innovation. For India, whose citizens account for nearly three-quarters of all H-1B professionals, the impact was immediate. The visa hike directly threatens the Indian information-technology sector, which has long been a backbone of the bilateral economic relationship.

Trump justified the decision as part of his “Hire American” campaign, portraying it as protection for domestic workers. But behind the rhetoric lies a clear political calculation. In an election year, cracking down on foreign labor plays well with his nationalist base, even if it undermines America’s own tech competitiveness. New Delhi, though displeased, has chosen not to respond with public outrage. Indian officials have conveyed their concerns through diplomatic channels, quietly reminding Washington that the H-1B system is not a loophole but a lifeline connecting two innovation economies. Many of America’s top technology firms are led by Indian-origin executives, a fact that underscores the partnership’s mutual benefit. India’s restraint reflects maturity: it will defend its interests firmly but without theatrics.

While the visa dispute grabbed headlines, it is the slow grind of trade negotiations that exposes the deeper tension. The long-discussed India-U.S. trade deal, first floated during Trump’s earlier tenure, remains mired in disputes over tariffs and market access. Both sides insist that talks are progressing, yet insiders admit the pace is glacial. Trump’s obsession with trade deficits has revived old arguments. Washington accuses New Delhi of maintaining high duties on American goods, from farm products to medical devices. India counters that U.S. subsidies and visa restrictions distort the playing field just as much. Behind these exchanges lies a philosophical clash: Trump’s “America First” protectionism versus India’s push for “Atmanirbhar Bharat,” or self-reliance. Still, neither country can afford to walk away. The United States is India’s largest trading partner, with bilateral commerce now exceeding 190 billion dollars, and both governments recognize that economic decoupling is not an option. One Indian negotiator likened the process to “a dance where both partners keep stepping on each other’s toes, but neither wants to leave the floor.”

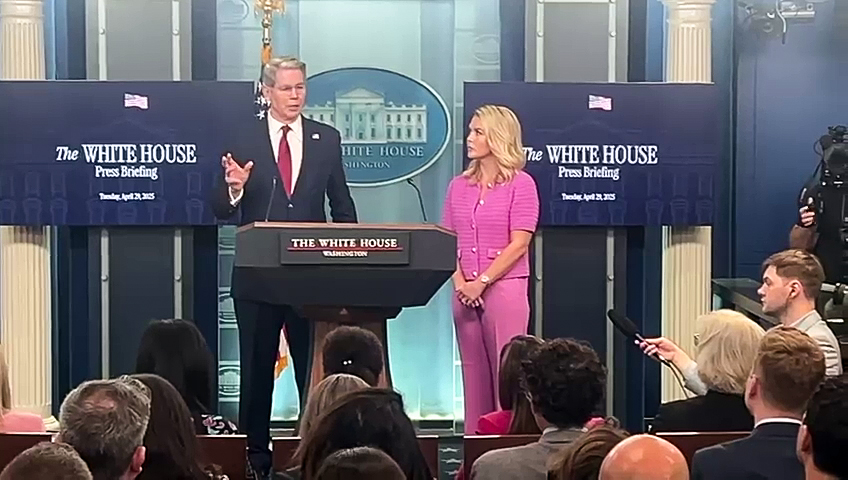

Three issues continue to define the relationship and generate friction: immigration, trade, and Pakistan. The first is now symbolized by the H-1B fee controversy, which Indian officials view as punitive rather than reformist. Trump’s aides defend the measure as necessary to protect American workers, but the backlash from U.S. corporations and universities reveals the policy’s self-defeating logic. The second irritant, tariffs, is a long-running dispute about how fast India should open its markets. Trump demands “reciprocal” trade access and faster liberalization, while New Delhi insists that domestic industries must be allowed to mature. The third and most politically sensitive issue is Pakistan. In recent months, Trump has sought to rebuild ties with Islamabad, praising its “constructive role” in counterterrorism and reopening channels of security cooperation that had gone cold.

For India, the shift is unsettling. After years of being sidelined in Washington, Pakistan suddenly finds itself courted again as a regional partner. U.S. officials argue that coordination with Islamabad is essential for stability in Afghanistan and counter-terrorism operations. Indian policymakers view this as a familiar American misjudgment—a short-term tactical move that ignores Pakistan’s long history of nurturing extremist networks. Yet New Delhi has avoided reacting publicly. Instead, it is doubling down on a broader diplomatic strategy that emphasizes diversification. By strengthening partnerships with Japan, Australia, France, and the Gulf states, India ensures that no single power, not even the United States, can hold undue leverage over its foreign policy.

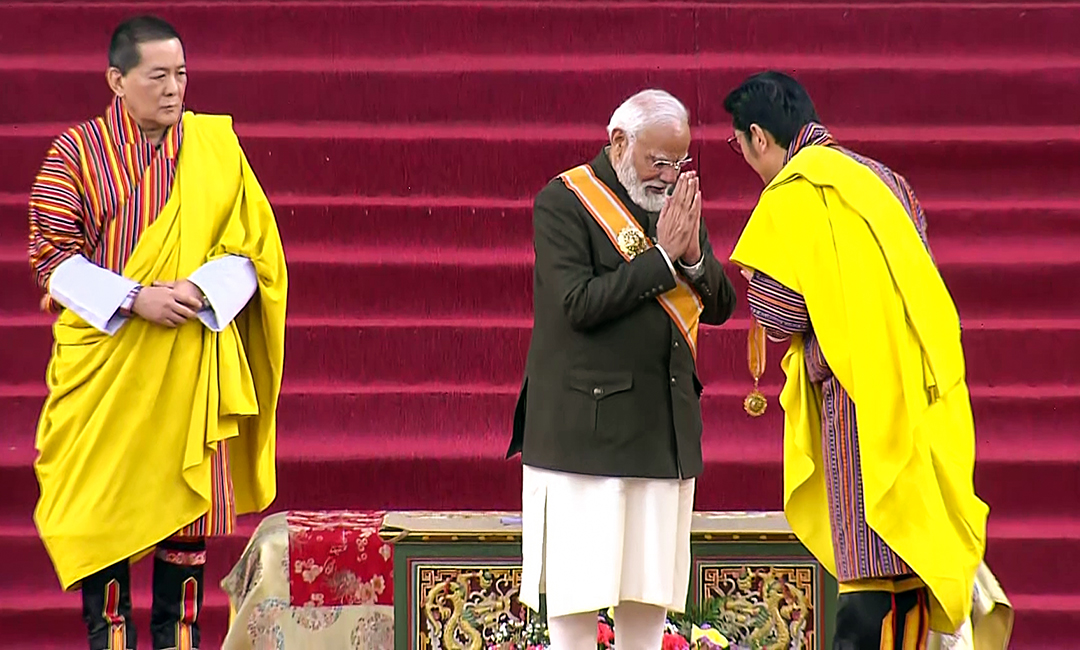

This quiet confidence is perhaps the most striking feature of India’s approach. In contrast to 2017, when Trump’s sudden policy shifts left many governments scrambling, India now seems unruffled. It engages Washington where interests align and resists where they diverge. Economic reforms at home, combined with a more assertive global role—visible in India’s leadership of the G20 and participation in the Quad—have given it the confidence to negotiate as an equal. The government’s strategy is one of calibrated patience: engage deeply but never depend entirely, and outlast the turbulence that comes with Trump’s style of governance.

The President’s outreach to Pakistan is a case in point. By reopening limited military-to-military exchanges and lifting some aid restrictions, Trump hopes to restore U.S. influence in South Asia. His aides call it pragmatism; Indian analysts call it nostalgia for a Cold War model that no longer works.

Even within the trade sphere, the picture is more nuanced than it appears. While Trump’s negotiators complain about India’s bureaucracy and slow decision-making, American companies continue to expand investment in the Indian market. U.S. defense and aerospace giants such as Boeing and Lockheed Martin are enlarging local production lines, while energy and digital-infrastructure firms see India as a long-term growth frontier. Beneath the noise of tariff disputes, the commercial foundation of the relationship remains solid. A Delhi-based economist observed that “Trump can slow the process with politics, but he cannot change the underlying logic of interdependence.”

Trump’s economic nationalism has also pushed India to accelerate its own diversification. Trade talks with the European Union, the United Arab Emirates, and Australia have gained momentum, providing India with alternative export markets. The message to Washington is subtle but unmistakable: India values partnership with the United States but will not be held hostage to its domestic politics. That confidence is reinforced by India’s growing stature in the Global South and its ability to speak for developing nations on energy, climate, and supply-chain resilience.

Still, Trump’s pressure is real. The visa fee cuts into India’s competitive edge in technology services; the trade impasse limits market access for key sectors; and the Pakistan tilt complicates security dynamics. Yet none of these challenges has produced panic in New Delhi. Instead, India’s response has been measured and strategic. Rather than issuing sharp public statements, it is quietly strengthening its internal economy and expanding diplomatic outreach. This restraint reflects a long-term calculation: Trump’s presidency, however turbulent, is just one phase in a relationship that will outlast any individual leader.

India’s foreign-policy establishment now views the United States less as a benefactor and more as a partner whose priorities fluctuate with its domestic politics. The Modi government’s bet is that enduring interests—shared concern over China’s assertiveness, mutual dependence in technology, and the vast Indian diaspora’s influence—will ensure that the partnership survives Trump’s periodic bouts of protectionism and unpredictability. The American establishment, too, remains invested in the relationship. The Chamber of Commerce’s legal challenge to the visa fee is itself a reminder that U.S. business recognizes the value of Indian talent and trade far more than political slogans suggest.

For all the friction, India and the United States continue to cooperate on defense, energy, and digital security. Joint military exercises such as Yudh Abhyas proceed uninterrupted, and intelligence sharing has deepened. These quiet continuities matter more than the noisy disputes. The alliance may lack the warmth of earlier years, but it has gained resilience. It now rests less on personal rapport between leaders and more on institutional depth.

Trump’s transactional instincts ensure that tension will remain a feature of the partnership. He measures relationships in deals and deficits, not in trust or long-term alignment. India’s approach is almost the opposite: patient, layered, and rooted in continuity. Yet, paradoxically, this difference in temperament has forced both sides to mature. India no longer seeks validation from Washington, and the United States increasingly acknowledges India as an indispensable player in Asia, even if disagreements persist.

The coming months will test whether Trump’s administration can translate pressure into genuine partnership. So far, India has chosen pragmatism over provocation. Its diplomats are betting that steady engagement will outlast Trump’s volatility. As one senior official in Washington observed, “The President plays for headlines. We play for history.”