India’s logistics cost as a percentage of GDP currently stands at 14 per cent, significantly higher than the 8-9 per cent range in developed countries

Our Bureau

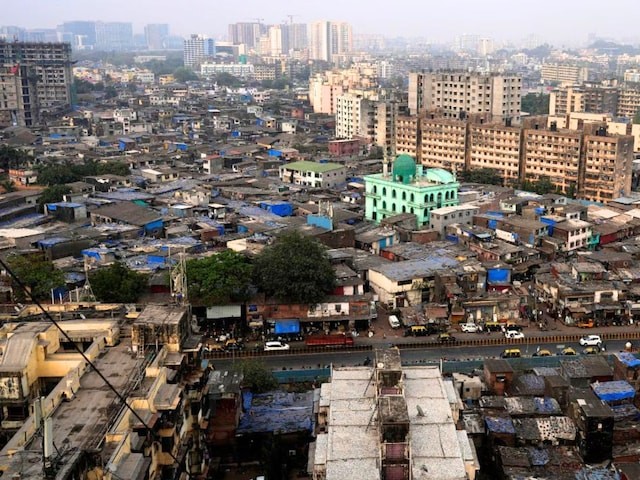

Mumbai

The Indian logistics market, valued at Rs 9 trillion in FY23, is projected to grow significantly, reaching Rs 13.4 trillion by FY28, registering a compounded annual growth rate (CAGR) of 8-9 per cent, according to a recent report by Motilal Oswal.

This growth is being fueled by structural shifts, technological advancements, and government initiatives aimed at reducing logistics costs and improving infrastructure.

The National Logistics Policy, unveiled in September 2022, has set goals to optimize India’s logistics landscape. It has focused on increasing the share of railways in the freight movement (currently at 18 per cent) through the development of dedicated freight corridors (DFCs), improving road infrastructure, and expanding inland waterways.

The commissioning of DFCs, which are 96 per cent complete as of April 2024, is set to boost the capacity and efficiency of rail freight, increasing its share in the overall modal mix.

Additionally, the government’s push for port privatization has led to improved infrastructure and efficiency at Indian ports, benefiting major operators like Adani Ports and SEZ (APSEZ) and JSW Infrastructure.

India’s logistics cost as a percentage of GDP currently stands at 14 per cent, significantly higher than the 8-9 per cent range in developed countries.

The skewed modal mix, with roads accounting for 71 per cent of freight movement, plays a major role in these elevated costs. In comparison, railways and waterways have a much smaller share of the logistics pie.

To tackle these inefficiencies, the government has implemented key initiatives such as the Goods and Services Tax (GST) and invested heavily in road infrastructure, inland waterways, and dedicated freight corridors (DFCs).

These measures are expected to reduce the logistics cost-to-GDP ratio to 8-9 per cent in the coming years, aligning India with global standards.

The logistics market is highly diverse, encompassing road transport, rail transport, air cargo, multimodal logistics, and industrial warehousing, among others.

The domestic express logistics segment is projected to grow at a faster pace, with a 14 per cent CAGR over FY23-28, driven largely by e-commerce expansion.

Organized players, who already control about 80 per cent of the market, are expected to solidify their dominance, leveraging government policies like the e-way bill and GST.

The less-than-truckload (LTL) segment in road transportation is also expected to witness notable growth, with a projected 10 per cent CAGR.

This growth has been spurred by the increased demand for smaller and more frequent shipments, bypassing warehouse storage, and directly reaching retailers.

BRICS+ nations are better prepared for challenges than G7

The BRICS+ group of countries are better placed to fiscally combat any future major economic crisis, as the countries in the BRICS+ group have a lower debt-GDP ratio, highlighted a report by Ernst & Young, an international consultation firm.

The report says that BRICS+ nations are placed at a stronger fiscal position than the G7 countries because they have a lower debt-GDP ratio and benefits of having access to higher primary deficits and a nearly equal excess of growth over interest rates.

“BRICS+ group is better placed to fiscally combat any future major economic crisis as it has a lower debt-GDP ratio, access to higher primary deficit, and a near equal excess of growth over interest rates as compared to the G7 group,” said the report.

The report emphasized that both the G7 and BRICS+ groups are crucial in shaping global economic trends. While G7 nations holds a larger share of global GDP when measured at market exchange rates, the BRICS+ group has a significant and growing share when evaluated in terms of Purchasing Power Parity (PPP).

It added that by 2029, BRICS+ is projected to have a 29.2 per cent share of the global GDP in market exchange terms and 38.3 per cent in PPP terms. In comparison, the G7’s share is expected to be 42.4 per cent in market exchange terms and 27.5 per cent in PPP terms.

The report highlighted that over the years, the G7’s share of global GDP has steadily declined. In 2002, the G7 accounted for 64.4 per cent of global GDP, but this has fallen to an estimated 44.4 per cent in 2024, a decline of 20 percentage points.

According to International Monetary Fund (IMF) projections, the G7’s share is expected to drop further to 42.4 per cent by 2029.